Your When was the cares act bill passed images are ready in this website. When was the cares act bill passed are a topic that is being searched for and liked by netizens now. You can Find and Download the When was the cares act bill passed files here. Get all free images.

If you’re looking for when was the cares act bill passed pictures information related to the when was the cares act bill passed interest, you have visit the ideal site. Our site frequently gives you hints for seeking the highest quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

When Was The Cares Act Bill Passed. A bill to provide emergency assistance and health care response for individuals families and businesses affected by the 2020 coronavirus pandemic. That bill the Middle Class Health Benefits Tax Repeal Act of 2019 had aimed at cutting taxes on certain health care plans. The bill authorizes emergency loans to distressed businesses including air carriers and suspends certain aviation excise taxes. It is the product.

Coronavirus Bulletin Resources For Leading During The Crisis Ways And Means Republicans From gop-waysandmeans.house.gov

Coronavirus Bulletin Resources For Leading During The Crisis Ways And Means Republicans From gop-waysandmeans.house.gov

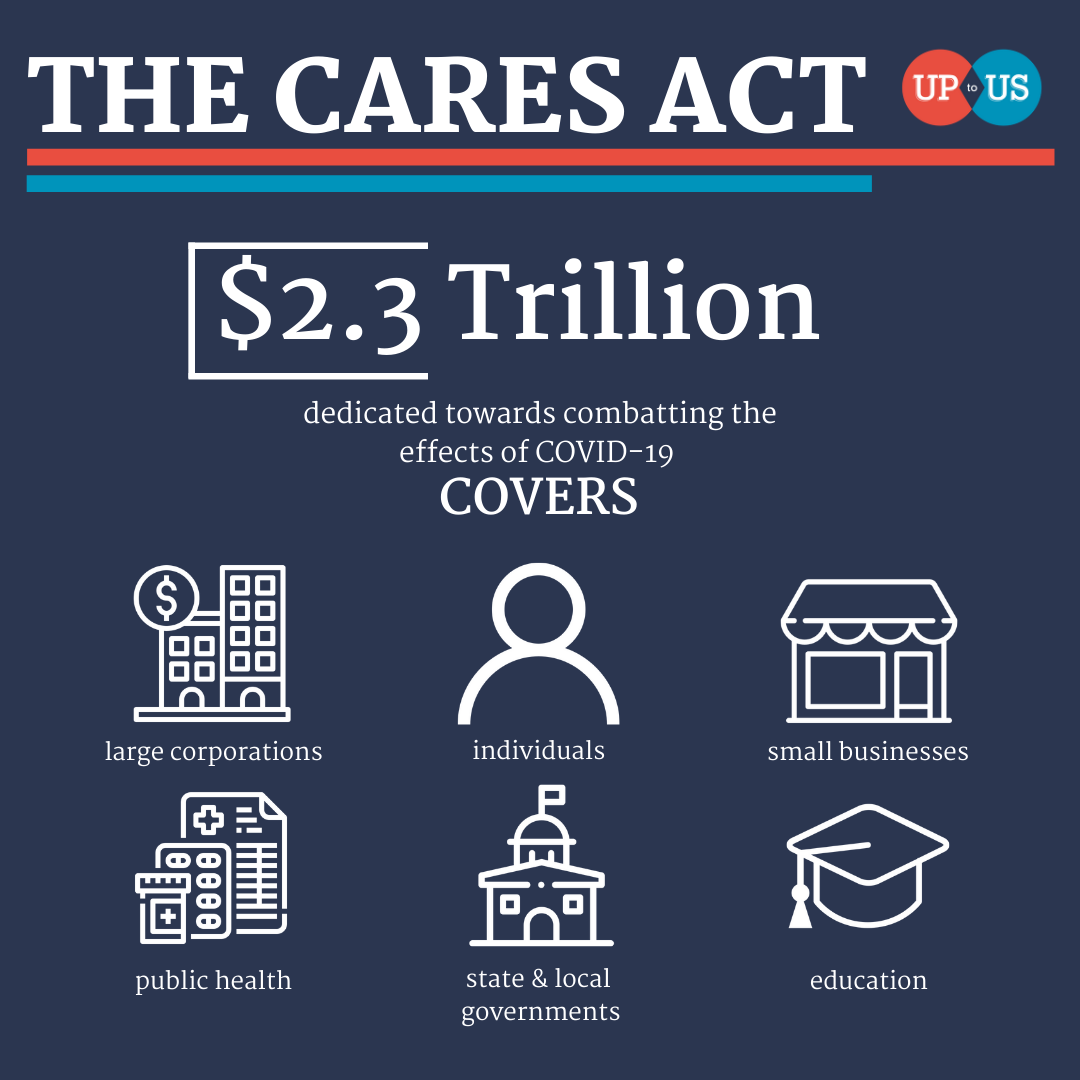

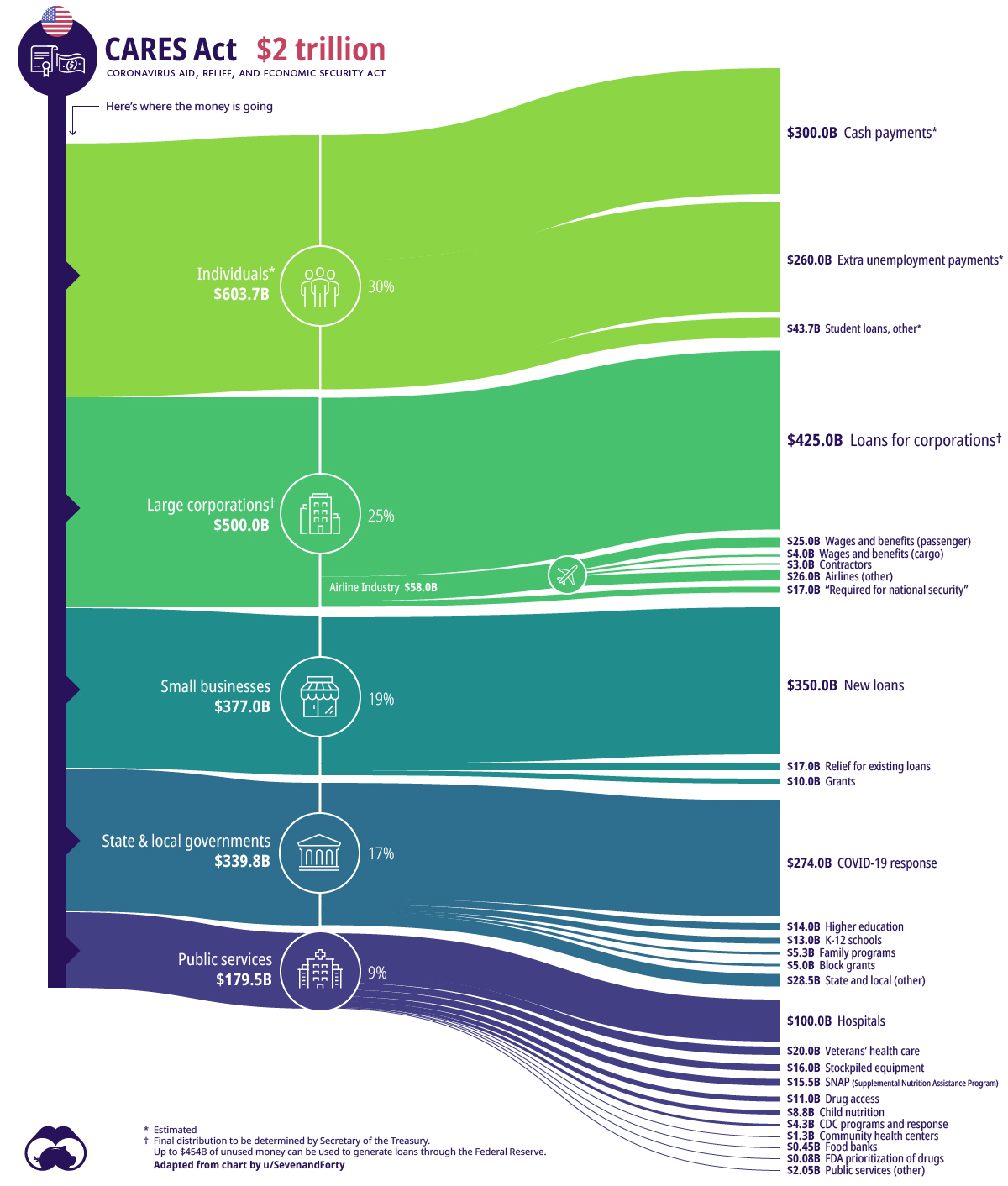

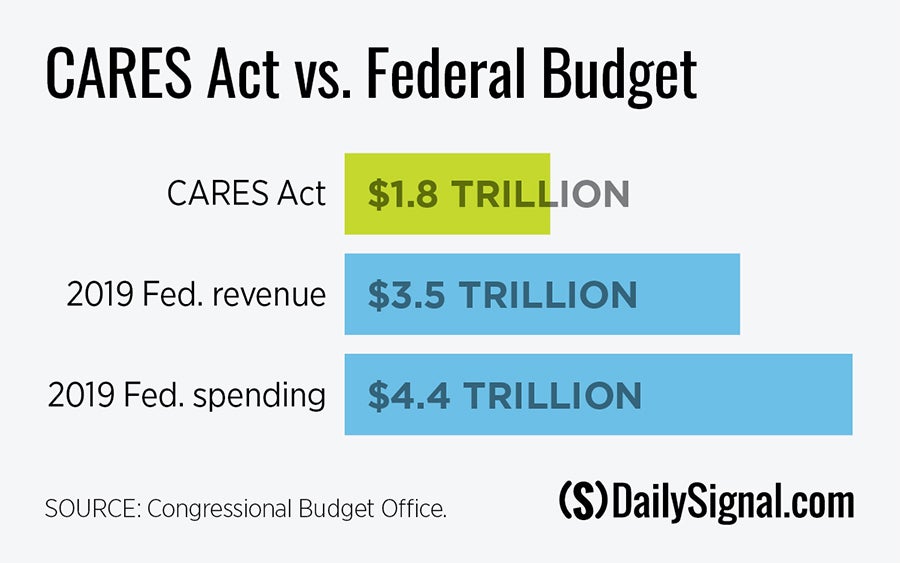

7 The table of contents for this Act is as follows. The CARES Act was signed into law on Friday March 27 2020. Looking ahead Congress may attempt to move on a fourth bill in response to the Coronavirus. The table of contents for this Act is as follows. The largest emergency response bill in history the CARES Act allocates nearly 2 trillion in emergency funding to provide relief to households small and large. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States.

The House-passed bill includes a one-year extension of the enhanced child tax credit child-care subsidies four weeks of paid leave an expansion of Medicare to cover hearing aids and more than.

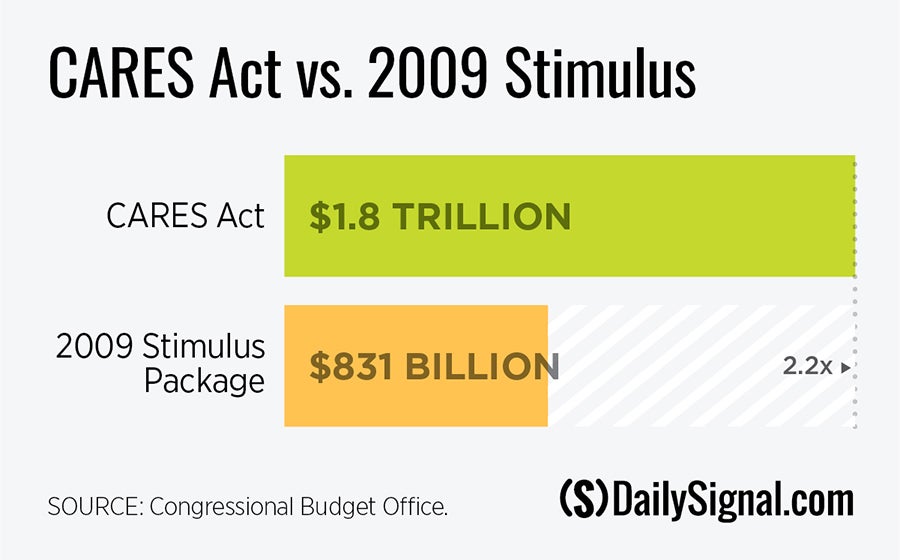

While that is great news in and of itself heres a look at some of the key. The House-passed bill includes a one-year extension of the enhanced child tax credit child-care subsidies four weeks of paid leave an expansion of Medicare to cover hearing aids and more than. The table of contents for this Act is as follows. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. This bill addresses economic impacts of and otherwise responds to the COVID-19 coronavirus outbreak. The CARES Act which passed in March is more than twice the size of the American Recovery and Reinvestment Act dwarfing what was previously the countrys largest stimulus package since World.

Source: itsuptous.org

Source: itsuptous.org

On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic. Richard Neal D-MA Chairman of the House Ways and Means Committee stated that In a fourth response package I want to provide any needed additional support to people who have lost their incomes and to. On March 27 2020 the Coronavirus Aid Relief and Economic Security CARES Act was signed into law amounting to over 2 trillion in aid. Who passed the CARES Act 2020. 24 2019 passed on July 17.

Source: pgpf.org

Source: pgpf.org

Latest Programs and Updates American Rescue Plan Six Month In total the Treasury Department is responsible for managing over 1 trillion in American Rescue Plan programs and tax credits. With respect to small businesses the bill. Richard Neal D-MA Chairman of the House Ways and Means Committee stated that In a fourth response package I want to provide any needed additional support to people who have lost their incomes and to. The bill authorizes emergency loans to distressed businesses including air carriers and suspends certain aviation excise taxes. The bill builds upon earlier versions of the CARES Act and is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout succeeding the 83 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

Source: visualcapitalist.com

Source: visualcapitalist.com

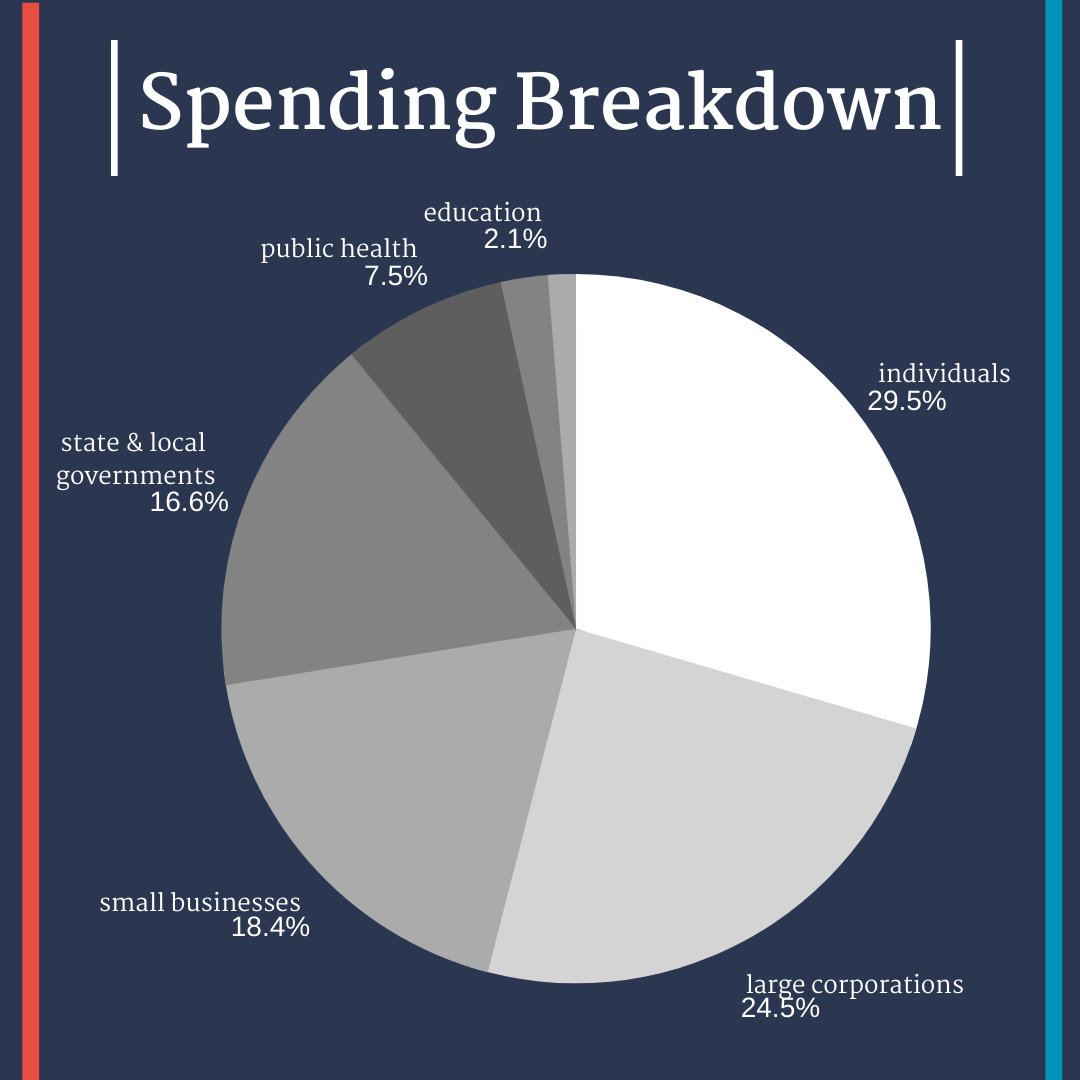

Text for S3548 - 116th Congress 2019-2020. The bill authorizes emergency loans to distressed businesses including air carriers and suspends certain aviation excise taxes. An image circulating on social media makes the claim that the Coronavirus Aid Relief and Economic Security Act known as the CARES Actwas introduced as a bill to Congress in January 2019. Details Of The Coronavirus Relief Bill The CARES Act The economic relief bill provides help to individuals businesses hospitals as. This Act may be cited as the Coronavirus Aid Relief and Economic Security Act or the CARES Act.

Source: heritage.org

Source: heritage.org

This bill addresses economic impacts of and otherwise responds to the COVID-19 coronavirus outbreak. On Friday March 27 the CARES Act passed. 116-136 03272020 Coronavirus Aid Relief and Economic Security Act or the CARES Act. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. This bill addresses economic impacts of and otherwise responds to the COVID-19 coronavirus outbreak.

Source: cnbc.com

Source: cnbc.com

Thats roughly 6000 per American or 45 of. 7 The table of contents for this Act is as follows. Richard Neal D-MA Chairman of the House Ways and Means Committee stated that In a fourth response package I want to provide any needed additional support to people who have lost their incomes and to. This bill addresses economic impacts of and otherwise responds to the COVID-19 coronavirus outbreak. On March 27 Congress passed the Coronavirus Aid Relief and Economic Security CARES Act the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic.

Source: forbes.com

Source: forbes.com

On Friday March 27 the CARES Act passed. In fact as the House was considering the CARES Act Rep. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH CARE. Latest Programs and Updates American Rescue Plan Six Month In total the Treasury Department is responsible for managing over 1 trillion in American Rescue Plan programs and tax credits. While that is great news in and of itself heres a look at some of the key.

Source: heritage.org

Source: heritage.org

Passed Senate under the order of 32520 having achieved 60 votes in the affirmative with an amendment by Yea-Nay Vote. This bill addresses economic impacts of and otherwise responds to the COVID-19 coronavirus outbreak. On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic. The CARES Act which passed in March is more than twice the size of the American Recovery and Reinvestment Act dwarfing what was previously the countrys largest stimulus package since World. Passed Senate Array actionDate 2020-03-25 displayText Passedagreed to in Senate.

Source: itsuptous.org

Source: itsuptous.org

7 The table of contents for this Act is as follows. On Friday March 27 the CARES Act passed. It is the product. On March 27 Congress passed the Coronavirus Aid Relief and Economic Security CARES Act the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic. The CARES Act was signed into law on Friday March 27 2020.

Source: foley.com

Source: foley.com

116-136 03272020 Coronavirus Aid Relief and Economic Security Act or the CARES Act. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. The table of contents for this Act is as follows. Apr 22 2020. Thats roughly 6000 per American or 45 of.

Source: brookings.edu

Source: brookings.edu

The table of contents for this Act is as follows. The House-passed bill includes a one-year extension of the enhanced child tax credit child-care subsidies four weeks of paid leave an expansion of Medicare to cover hearing aids and more than. Economic Impact Payments The Treasury Department the Office of Fiscal. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. That bill the Middle Class Health Benefits Tax Repeal Act of 2019 had aimed at cutting taxes on certain health care plans.

Looking ahead Congress may attempt to move on a fourth bill in response to the Coronavirus. Coronavirus Aid Relief and Economic Security Act or the CARES Act. Latest Programs and Updates American Rescue Plan Six Month In total the Treasury Department is responsible for managing over 1 trillion in American Rescue Plan programs and tax credits. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. A bill to provide emergency assistance and health care response for individuals families and businesses affected by the 2020 coronavirus pandemic.

Source: npr.org

Source: npr.org

24 2019 passed on July 17. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH CARE. The largest emergency response bill in history the CARES Act allocates nearly 2 trillion in emergency funding to provide relief to households small and large. The table of contents for this Act is as follows. Richard Neal D-MA Chairman of the House Ways and Means Committee stated that In a fourth response package I want to provide any needed additional support to people who have lost their incomes and to.

Source: itsuptous.org

Source: itsuptous.org

In fact as the House was considering the CARES Act Rep. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. In fact as the House was considering the CARES Act Rep. The largest emergency response bill in history the CARES Act allocates nearly 2 trillion in emergency funding to provide relief to households small and large. With respect to small businesses the bill.

Source: kff.org

Source: kff.org

Coronavirus Aid Relief and Economic Security Act or the CARES Act. Richard Neal D-MA Chairman of the House Ways and Means Committee stated that In a fourth response package I want to provide any needed additional support to people who have lost their incomes and to. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH. 7 The table of contents for this Act is as follows. In fact as the House was considering the CARES Act Rep.

Source: kff.org

Source: kff.org

7 The table of contents for this Act is as follows. An image circulating on social media makes the claim that the Coronavirus Aid Relief and Economic Security Act known as the CARES Actwas introduced as a bill to Congress in January 2019. The bill authorizes emergency loans to distressed businesses including air carriers and suspends certain aviation excise taxes. Latest Programs and Updates American Rescue Plan Six Month In total the Treasury Department is responsible for managing over 1 trillion in American Rescue Plan programs and tax credits. Apr 22 2020.

Source: heritage.org

Source: heritage.org

The House-passed bill includes a one-year extension of the enhanced child tax credit child-care subsidies four weeks of paid leave an expansion of Medicare to cover hearing aids and more than. A bill to provide emergency assistance and health care response for individuals families and businesses affected by the 2020 coronavirus pandemic. On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic. That bill the Middle Class Health Benefits Tax Repeal Act of 2019 had aimed at cutting taxes on certain health care plans. The CARES Act which passed in March is more than twice the size of the American Recovery and Reinvestment Act dwarfing what was previously the countrys largest stimulus package since World.

Latest Programs and Updates American Rescue Plan Six Month In total the Treasury Department is responsible for managing over 1 trillion in American Rescue Plan programs and tax credits. Economic Impact Payments The Treasury Department the Office of Fiscal. This bill responds to the COVID-19 ie coronavirus disease 2019 outbreak and its impact on the economy public health state and local governments individuals and businesses. 7 The table of contents for this Act is as follows. It is the product.

Source: gop-waysandmeans.house.gov

Source: gop-waysandmeans.house.gov

With respect to small businesses the bill. On March 27 Congress passed the Coronavirus Aid Relief and Economic Security CARES Act the third phase of legislation designed to lessen the economic impact of the COVID-19 pandemic. The largest emergency response bill in history the CARES Act allocates nearly 2 trillion in emergency funding to provide relief to households small and large. The bill authorizes emergency loans to distressed businesses including air carriers and suspends certain aviation excise taxes. The CARES Act which passed in March is more than twice the size of the American Recovery and Reinvestment Act dwarfing what was previously the countrys largest stimulus package since World.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title when was the cares act bill passed by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.