Your Cares act student loans refund images are ready in this website. Cares act student loans refund are a topic that is being searched for and liked by netizens today. You can Find and Download the Cares act student loans refund files here. Find and Download all free photos.

If you’re searching for cares act student loans refund images information connected with to the cares act student loans refund keyword, you have visit the ideal blog. Our site always provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Cares Act Student Loans Refund. When your student loans go into default there are several potential consequences ranging from an impact on your credit score to a tax refund offset on student loans. Private student loans and federal student loans not owned by the Education Department are not covered by the CARES Act. The CARES Act allows a plan sponsor to increase the maximum loan limit for qualified participants from 50000 to 100000 until September 23 2020. In addition the interest on these federal student loans will automatically drop to zero percent between March 13 2020 and May 1 2022.

Federal Student Loans Under The Cares Act Borrower And Employer Guidance Frost Brown Todd Full Service Law Firm From frostbrowntodd.com

Federal Student Loans Under The Cares Act Borrower And Employer Guidance Frost Brown Todd Full Service Law Firm From frostbrowntodd.com

On Friday afternoon the Coronavirus Aid Relief and Economic Security CARES Act passed the House of Representatives by a voice vote. Utilized all available sources of financial aid including federal student loans. 748 3513 gives temporary relief to federal student loan borrowers in the form of 1 payment and interest accrual suspension and 2 consideration of suspended payments toward loan forgiveness. Covers approximately 95 of borrowers excludes federal debt held by private companies Federal Family Education Loan program and federal debt held by colleges and universities. However these repayments are considered taxable for PIT purposes. The CARES Act corrects this and lets businesses go back and amend tax returns for 2018 and 2019 to claim the write off potentially giving them a welcome tax refund.

Section 2206 of the CARES Act allows a portion of student loan payments to be excluded from income.

The President then signed the bill into law. The spending primarily includes 300 billion in one-time cash payments to. Students must have an active local or mailing address in the TTU system for any refund ACH or check to be issued. Coronavirus COVID-19 CARES Act Student Loan Fact Sheet Payments automatically deferred and interest is waived on federally held student loans through Sept. Section 2206 of the CARES Act allows a portion of student loan payments to be excluded from income. Employers who help repay employee student loans take a big step in forming lasting trust and partnership with valued staff.

Source: npr.org

Source: npr.org

However these repayments are considered taxable for PIT purposes. Students must have an active local or mailing address in the TTU system for any refund ACH or check to be issued. The final quarterly posting as of October 10 2020 is the final report that covers all remaining HEERF fund expenditures for Section 18004a1 Student Portion funds. It is the students responsibility to maintain a correct active address with TTU to ensure receipt of payment from TTU. The spending primarily includes 300 billion in one-time cash payments to.

Source: texarkanacollege.edu

Source: texarkanacollege.edu

For 2020 the federal excise tax on distilled spirits is waived if it is being used for hand sanitizer. Federal Student Aid. The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through December 31 2025. 1 2020 to Sept. The CARES Act.

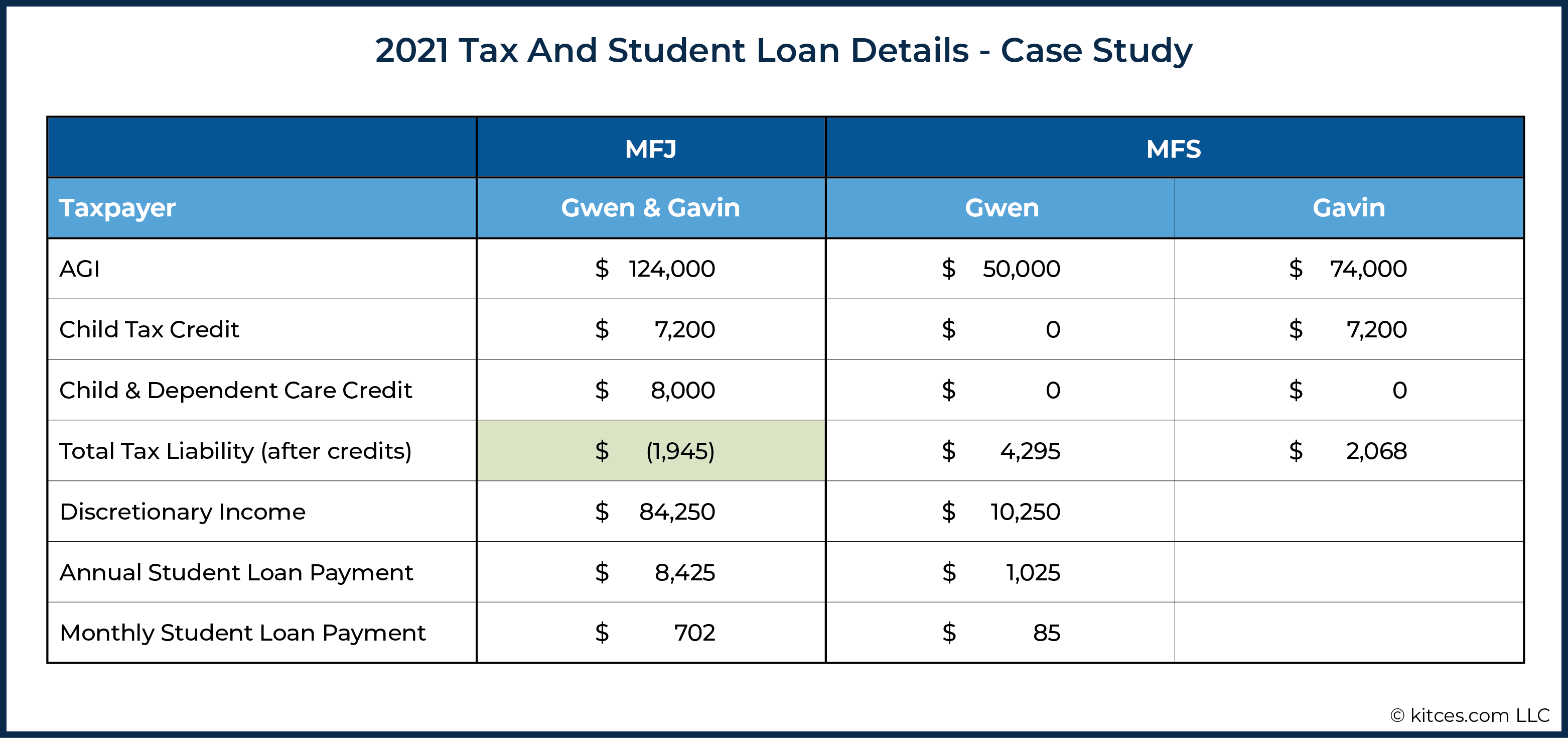

Source: kitces.com

Source: kitces.com

The CARES Act allows a plan sponsor to increase the maximum loan limit for qualified participants from 50000 to 100000 until September 23 2020. Coronavirus COVID-19 CARES Act Student Loan Fact Sheet Payments automatically deferred and interest is waived on federally held student loans through Sept. Employers may contribute up to 5250 annually toward student loans and the payments would be excluded from an employees income. Thank you for your interest in applying for the CARES Act student emergency grants. The Coronavirus Aid Relief and Economic Security CARES ActTax Relief Congressional Research Service 2 The report also summarizes tax provisions in earlier versions of the CARES Actthe first version of the CARES Act S.

Source: studentloanborrowerassistance.org

Source: studentloanborrowerassistance.org

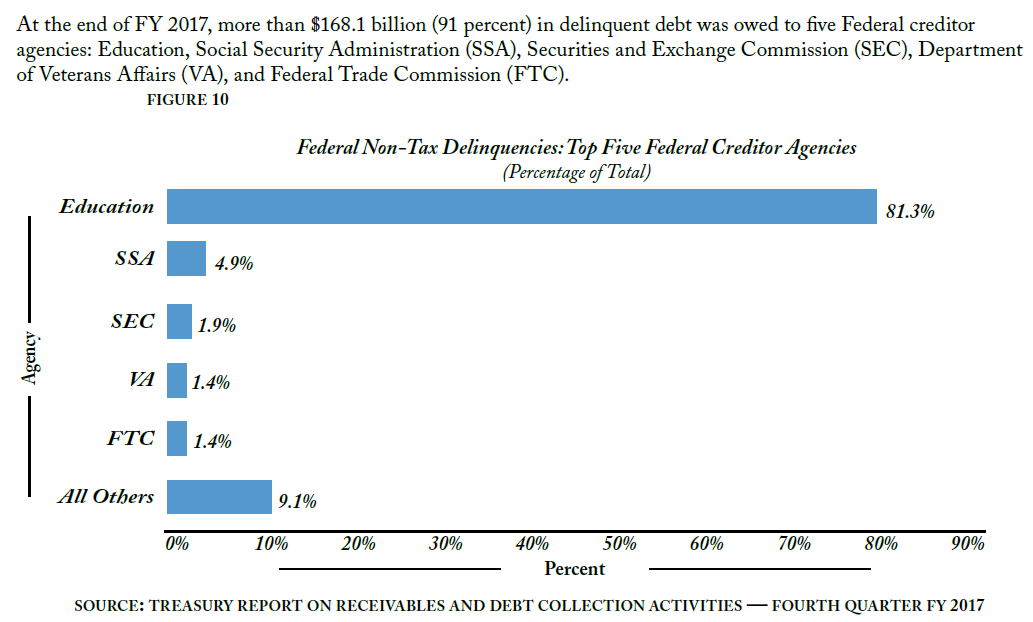

Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in section 2 of Pub. Covers approximately 95 of borrowers excludes federal debt held by private companies Federal Family Education Loan program and federal debt held by colleges and universities. STUDENT LOAN DEBT. Demonstrated a financial hardship due to the COVID-19 pandemic. To have qualified for funds other than CARES Act funds students must have.

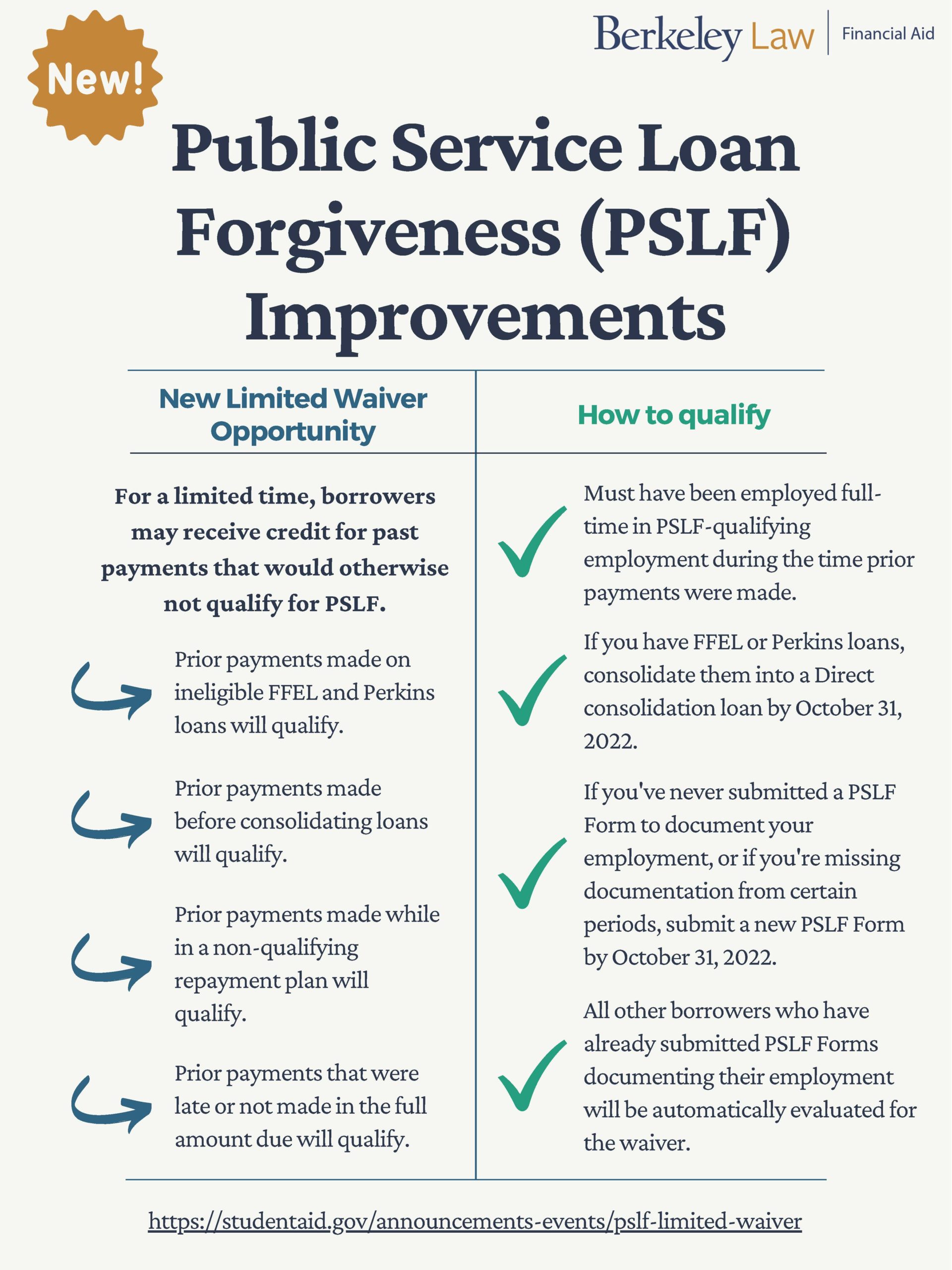

Source: law.berkeley.edu

Source: law.berkeley.edu

When your student loans go into default there are several potential consequences ranging from an impact on your credit score to a tax refund offset on student loans. But under the CARES Act all federal student loans have been automatically placed in forbearance. In addition the interest on these federal student loans will automatically drop to zero percent between March 13 2020 and May 1 2022. STUDENT LOAN DEBT. To have qualified for funds other than CARES Act funds students must have.

Source: frostbrowntodd.com

Source: frostbrowntodd.com

However these repayments are considered taxable for PIT purposes. Economic Impact Payments The Treasury Department the Office of Fiscal. The President then signed the bill into law. When your student loans go into default there are several potential consequences ranging from an impact on your credit score to a tax refund offset on student loans. 3548 Table A-1 as well as the version released March 22 2020 Table A-26 Table 1.

Source: studentaid.gov

Source: studentaid.gov

Coronavirus COVID-19 CARES Act Student Loan Fact Sheet Payments automatically deferred and interest is waived on federally held student loans through Sept. The spending primarily includes 300 billion in one-time cash payments to. Section 2206 of the CARES Act allows a portion of student loan payments to be excluded from income. Extends the Real ID deadline from Oct. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States.

3548 Table A-1 as well as the version released March 22 2020 Table A-26 Table 1. 748 3513 gives temporary relief to federal student loan borrowers in the form of 1 payment and interest accrual suspension and 2 consideration of suspended payments toward loan forgiveness. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021. 2020-21 CARES Act Institutional Reporting. Ohio University received FAFSA applications for 21779 s tudents for the 2020-21 year.

Source: cbo.gov

Source: cbo.gov

The CARES Act corrects this and lets businesses go back and amend tax returns for 2018 and 2019 to claim the write off potentially giving them a welcome tax refund. For 2020 the federal excise tax on distilled spirits is waived if it is being used for hand sanitizer. 636a shall be considered to have delegated authority to make and approve loans under such section 7a based on an evaluation of the eligibility of the borrower. So you wont be charged anything on your student loans until May 2022 not even interest paymentsbut youre still able to keep paying on them if you want. The final quarterly posting as of October 10 2020 is the final report that covers all remaining HEERF fund expenditures for Section 18004a1 Student Portion funds.

Source: forgivemystudentdebt.org

Source: forgivemystudentdebt.org

The President then signed the bill into law. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. STUDENT LOAN DEBT. Employers who help repay employee student loans take a big step in forming lasting trust and partnership with valued staff. The final quarterly posting as of October 10 2020 is the final report that covers all remaining HEERF fund expenditures for Section 18004a1 Student Portion funds.

Source: ticas.org

Source: ticas.org

Student Loans Deferral Programs-Borrowers who have a federal student loan may have the opportunity to defer monthly student loan payments without any penalty through September 30 2020. Ohio University received CARES Act Sections 18004a1 Institutional. The President then signed the bill into law. STUDENT LOAN DEBT. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021.

Source: forbes.com

Source: forbes.com

Student Loans Deferral Programs-Borrowers who have a federal student loan may have the opportunity to defer monthly student loan payments without any penalty through September 30 2020. So you wont be charged anything on your student loans until May 2022 not even interest paymentsbut youre still able to keep paying on them if you want. 748 3513 gives temporary relief to federal student loan borrowers in the form of 1 payment and interest accrual suspension and 2 consideration of suspended payments toward loan forgiveness. Ohio University received FAFSA applications for 21779 s tudents for the 2020-21 year. The CARES Act.

Source: ncsl.org

Source: ncsl.org

Locally on May 13 Central Alabama Community College CACC received over 12 million dollars from the HEERF. Employers may contribute up to 5250 annually toward student loans and the payments would be excluded from an employees income. The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR. The spending primarily includes 300 billion in one-time cash payments to. It is the students responsibility to maintain a correct active address with TTU to ensure receipt of payment from TTU.

Source: educationdata.org

Source: educationdata.org

With the new Coronavirus Aid Relief and Economic Security Act CARES Act a temporary tax-free provision is provided for employer student loan assistance programs. The IRS also says that people who have filed or plan to can still expect to receive a refund if they are owed one. The CARES Act corrects this and lets businesses go back and amend tax returns for 2018 and 2019 to claim the write off potentially giving them a welcome tax refund. Locally on May 13 Central Alabama Community College CACC received over 12 million dollars from the HEERF. Student Loans Deferral Programs-Borrowers who have a federal student loan may have the opportunity to defer monthly student loan payments without any penalty through September 30 2020.

Source: lonestar.edu

Source: lonestar.edu

636a shall be considered to have delegated authority to make and approve loans under such section 7a based on an evaluation of the eligibility of the borrower. The IRS also says that people who have filed or plan to can still expect to receive a refund if they are owed one. The CARES Act provides that certain student loan repayments made by an employer up to 5250 will not be subject to Federal Income Tax. The CARES Act allows a plan sponsor to increase the maximum loan limit for qualified participants from 50000 to 100000 until September 23 2020. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US.

Source: ticas.org

Source: ticas.org

Federal Student Aid. Ohio University received FAFSA applications for 21779 s tudents for the 2020-21 year. Alcohol used to produce hand sanitizer. STUDENT LOAN DEBT. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021.

Source: studentaid.gov

Source: studentaid.gov

636a shall be considered to have delegated authority to make and approve loans under such section 7a based on an evaluation of the eligibility of the borrower. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. Having a tax refund offset on your student loans could result in less money than expected during tax season setting you back on your financial goals. Ohio University received FAFSA applications for 21779 s tudents for the 2020-21 year. Federal Student Aid.

Source: forbes.com

Source: forbes.com

STUDENT LOAN DEBT. To have qualified for funds other than CARES Act funds students must have. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. However these repayments are considered taxable for PIT purposes. But under the CARES Act all federal student loans have been automatically placed in forbearance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cares act student loans refund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.