Your Cares act student loans employer images are available. Cares act student loans employer are a topic that is being searched for and liked by netizens now. You can Get the Cares act student loans employer files here. Get all free images.

If you’re looking for cares act student loans employer images information linked to the cares act student loans employer interest, you have pay a visit to the right blog. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

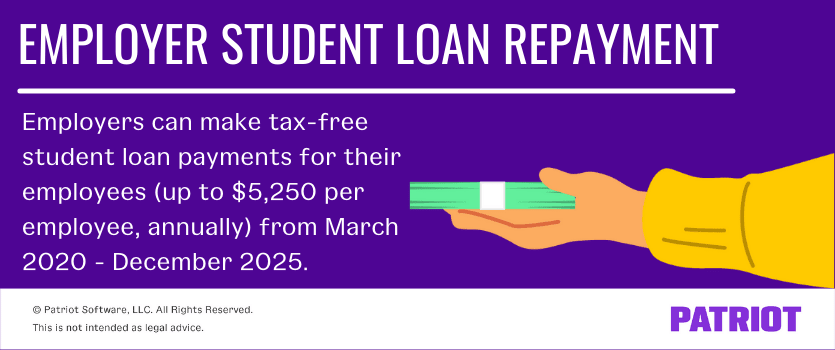

Cares Act Student Loans Employer. Student loan deferments. Employer payments of student loans Temporarily expands the definition of employer-sponsored educational assistance to include qualified student loan payments made to employees in 2020. Helping employees pay their student loans. Under the new law no payments are required on federal student loans owned by the US.

What S In The Cares Act Higher Education Student Debt The Institute For College Access Success From ticas.org

What S In The Cares Act Higher Education Student Debt The Institute For College Access Success From ticas.org

Allows companies to pay up to 5250 of employees student loan payments on a tax-free basis through Dec. Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. Student loan deferments. Text for HR748 - 116th Congress 2019-2020. The CARES Act and Employer Student Loan Contributions. The President then signed the bill into law.

The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through December 31 2025.

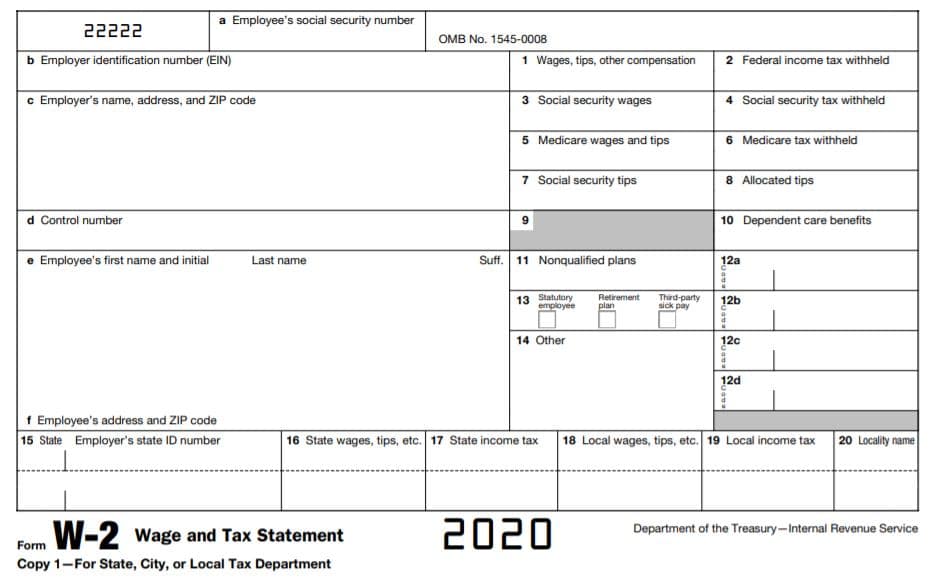

The amount of the student loan debt repayment made by the employer on behalf of an employee. The CARES Act provides that certain student loan repayments made by an employer up to 5250 will not be subject to Federal Income Tax. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021. However these repayments are considered taxable for PIT purposes. The CARES Act allows employers to pay up to 5250 toward student loans on behalf of employees and the employees would not owe US. The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR.

Source: pinterest.com

Source: pinterest.com

The new bill extends that until the end of 2025. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021. The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through December 31 2025. The CARES Act modifies this tax treatment for payments made after March 27. The waived interest and deferred payments are automatic so you do.

Source: patriotsoftware.com

Source: patriotsoftware.com

Employer payments of student loans Temporarily expands the definition of employer-sponsored educational assistance to include qualified student loan payments made to employees in 2020. The CARES Act is part of a series of legislative packages addressing the COVID-19 pandemic. The President then signed the bill into law. In March 2020 Congress passed the CARES Act not only pausing payments but setting interest rates on student loans to 0 and halting collections on defaulted student loans. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021.

Source: employeebenefitslawreport.com

Source: employeebenefitslawreport.com

Employer payments of student loans Temporarily expands the definition of employer-sponsored educational assistance to include qualified student loan payments made to employees in 2020. Allows companies to pay up to 5250 of employees student loan payments on a tax-free basis through Dec. Almost 6 million federal student loan borrowers cant get any relief from the CARES Act because a commercial lender holds their loans according to calculations by Travis Hornsby the founder of. STUDENT LOAN DEBT. With the end of the CARES Act on Jan.

Source: patriotsoftware.com

Source: patriotsoftware.com

The CARES Act allows employers to make payments of up to 5250 tax free toward employees student loans through the end of this year. In addition to establishing the Paycheck Protection Program and Employee Retention Credit the CARES Act made employer student loan repayments tax-free until the end of 2020. The waived interest and deferred payments are automatic so you do. You cant get the special tax and CARES Act treatments for amounts that you take out that are more than 100000 total from all of your accounts. The CARES Act provides that certain student loan repayments made by an employer up to 5250 will not be subject to Federal Income Tax.

Source: studentloanplanner.com

Source: studentloanplanner.com

Almost 6 million federal student loan borrowers cant get any relief from the CARES Act because a commercial lender holds their loans according to calculations by Travis Hornsby the founder of. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Helping employees pay their student loans. 31 borrowers will face increasing financial pressure as monthly payments resume. The CARES Act allows employers to make payments of up to 5250 tax free toward employees student loans through the end of this year.

Source: studentloanplanner.com

Source: studentloanplanner.com

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Under the new law no payments are required on federal student loans owned by the US. Employers who help repay employee student loans take a big step in forming lasting trust and partnership with valued staff. On Friday afternoon the Coronavirus Aid Relief and Economic Security CARES Act passed the House of Representatives by a voice vote. Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee.

Source: studentaid.gov

Source: studentaid.gov

Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. Section 2206 of the CARES Act allows a portion of student loan payments to be excluded from income. Employers may contribute up to 5250 annually toward student loans and the payments would be excluded from an employees income. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Loans are offered in amounts of 250 500 750 1250 or 3500.

Source: experian.com

Source: experian.com

The new bill extends that until the end of 2025. The spending primarily includes 300 billion in one-time cash payments to. Student loan deferments. The CARES Act modifies this tax treatment for payments made after March 27. That means an employer could contribute to loan payments and workers wouldnt have to include that.

Source: pinterest.com

Source: pinterest.com

The CARES Act provides that certain student loan repayments made by an employer up to 5250 will not be subject to Federal Income Tax. The newly passed stimulus bill also includes provisions related to employer benefits other than retirement plans. You cant get the special tax and CARES Act treatments for amounts that you take out that are more than 100000 total from all of your accounts. 748 3513 gives temporary relief to federal student loan borrowers in the form of 1 payment and interest accrual suspension and 2 consideration of suspended payments toward loan forgiveness. It is not your tax refund.

Source: ticas.org

Source: ticas.org

The CARES Act also reduces the cost of participation in the program by providing fee waivers an automatic deferment of payments for up to one year and no prepayment penalties. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in section 2 of Pub. The Coronavirus Aid Relief and Economic Security CARES Act signed into law in March 2020 temporarily allowed employers to provide up. And in December 2020 the Consolidated Appropriations Act extended the tax-free program through December 2025. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021.

Source: plansponsor.com

Source: plansponsor.com

The waived interest and deferred payments are automatic so you do. Before the CARES Act she would have been required to take the entire balance in the IRA by December 31 2023. The CARES Act allows employers to pay up to 5250 toward student loans on behalf of employees and the employees would not owe US. Student loan deferments. That means an employer could contribute to loan payments and workers wouldnt have to include that.

Source: bench.co

Source: bench.co

The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Section 2206 of the Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 expands the definition of educational assistance described in section 2 of Pub. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. Department of Education between March 13 2020 and May 1 2022. 636a shall be considered to have delegated authority to make and approve loans under such section 7a based on an evaluation of the eligibility of the borrower.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

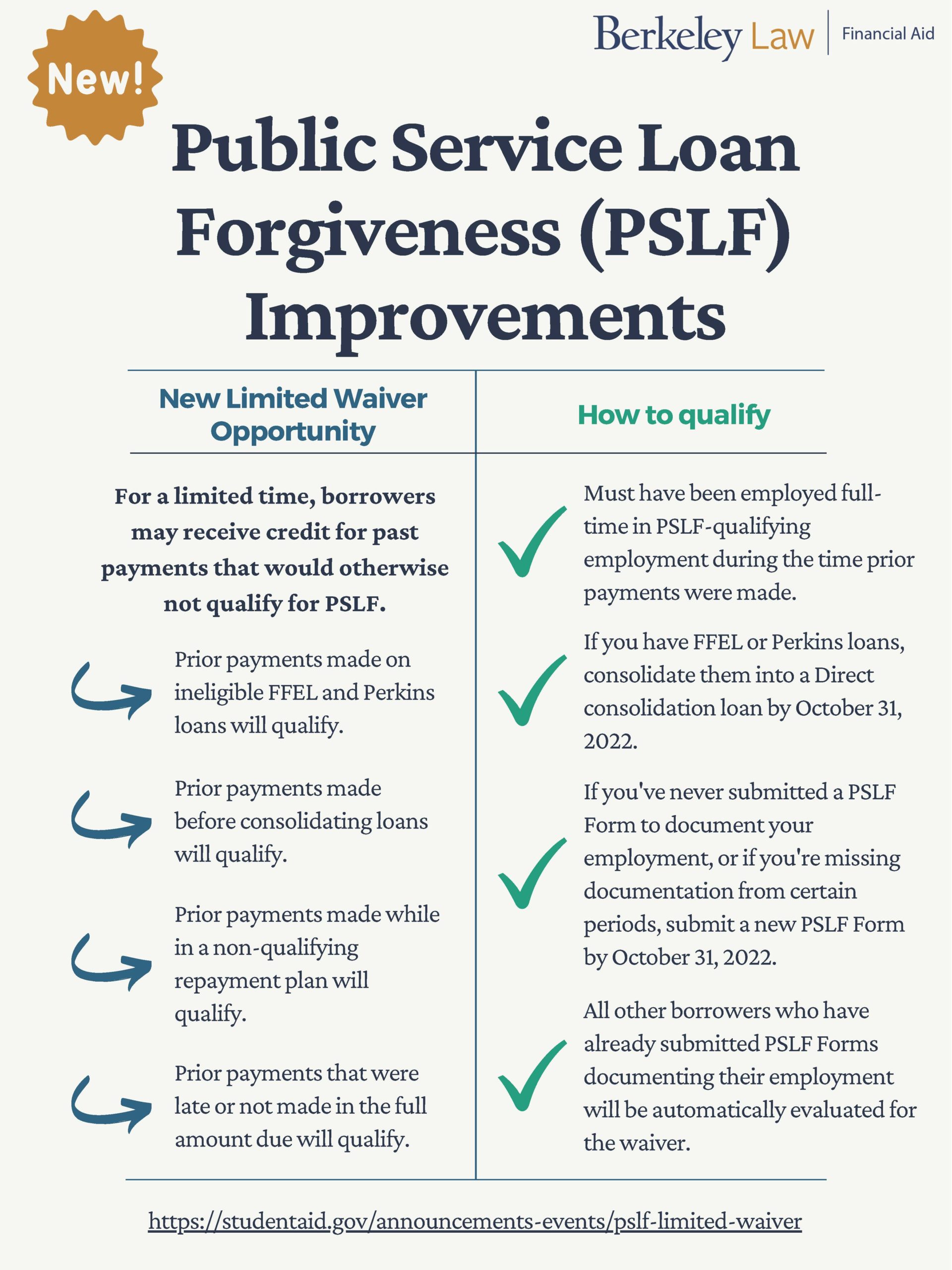

Helping employees pay their student loans. The CARES Act and Employer Student Loan Contributions. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. Department of Education between March 13 2020 and May 1 2022. With the new Coronavirus Aid Relief and Economic Security Act CARES Act a temporary tax-free provision is provided for employer student loan assistance programs.

Source: law.berkeley.edu

Source: law.berkeley.edu

The CARES Act protections are still in place meaning that waived interest and deferred payments on federal student loans through January 31 2022. The CARES Act modifies this tax treatment for payments made after March 27. The waived interest and deferred payments are automatic so you do. However these repayments are considered taxable for PIT purposes. Employers may contribute up to 5250 annually toward student loans and the payments would be excluded from an employees income.

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. Helping employees pay their student loans. That means an employer could contribute to loan payments and workers wouldnt have to include that. On Friday afternoon the Coronavirus Aid Relief and Economic Security CARES Act passed the House of Representatives by a voice vote. In March 2020 Congress passed the CARES Act not only pausing payments but setting interest rates on student loans to 0 and halting collections on defaulted student loans.

Source: pinterest.com

Source: pinterest.com

Text for HR748 - 116th Congress 2019-2020. The CARES Act is part of a series of legislative packages addressing the COVID-19 pandemic. With the end of the CARES Act on Jan. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. However these repayments are considered taxable for PIT purposes.

The new bill extends that until the end of 2025. 636a shall be considered to have delegated authority to make and approve loans under such section 7a based on an evaluation of the eligibility of the borrower. Section 2206 of the CARES Act allows a portion of student loan payments to be excluded from income. Almost 6 million federal student loan borrowers cant get any relief from the CARES Act because a commercial lender holds their loans according to calculations by Travis Hornsby the founder of. Payments would be excluded from income and payroll taxes both the employee and employer portion.

Source: mossadams.com

Source: mossadams.com

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. In addition to establishing the Paycheck Protection Program and Employee Retention Credit the CARES Act made employer student loan repayments tax-free until the end of 2020. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. The Coronavirus Aid Relief and Economic Security CARES Act signed into law in March 2020 temporarily allowed employers to provide up. Loans are offered in amounts of 250 500 750 1250 or 3500.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cares act student loans employer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.