Your Cares act student loan repayment employer images are ready in this website. Cares act student loan repayment employer are a topic that is being searched for and liked by netizens now. You can Find and Download the Cares act student loan repayment employer files here. Get all free photos.

If you’re looking for cares act student loan repayment employer pictures information related to the cares act student loan repayment employer keyword, you have come to the right blog. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and find more informative video content and images that match your interests.

Cares Act Student Loan Repayment Employer. Tax Exclusion for Employer Student Loan Repayment Benefits Section 2206 Updated. The CARES Act and Employer Student Loan Contributions. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. But while it hasnt gotten as much attention as the relief stimulus checks the CARES Act has temporarily made employer student loan assistance payments tax-free through the end of 2020.

Student Loan Expert Calls Repayment System Frankenstein S Monster Student Loans Student Loan Repayment Repayment From pinterest.com

Student Loan Expert Calls Repayment System Frankenstein S Monster Student Loans Student Loan Repayment Repayment From pinterest.com

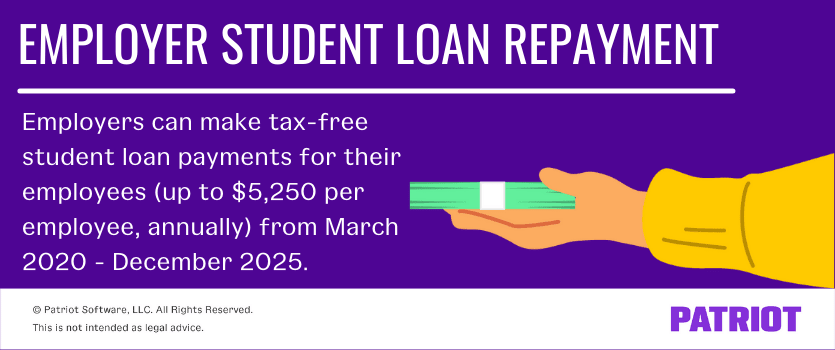

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. Employer Student Loan Benefits. Under the Coronavirus Aid Relief and Economic Security CARES Act employers can now make nontaxable payments of up to 5250 to employees as student loan repayment assistance but only if the payments are made by December 31 2020 under an educational assistance program that meets the requirements of Internal Revenue Code Code Section 127. 3548 Table A-1 as well as the version released March 22 2020 Table A-26 Table 1. And in December 2020 the Consolidated Appropriations Act extended the tax-free program through December 2025. The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR.

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers.

It similarly extends the one-year delay in loan repayment for participants with repayment due dates between the first day of the disaster incident period and ending 180 days after the last day of the period. The Coronavirus Aid Relief and Economic Security CARES ActTax Relief Congressional Research Service 2 The report also summarizes tax provisions in earlier versions of the CARES Actthe first version of the CARES Act S. Tax Exclusion for Employer Student Loan Repayment Benefits Section 2206 Updated. Online student loan repayment management tools to help employees pay down student loan debt. In March 2020 Congress passed the CARES Act not only pausing payments but setting interest rates on student loans to 0 and halting collections on defaulted student loans. 636a for which an application is approved or pending approval on or after the date of enactment of this Act the maximum loan amount shall be the lesser of 1 the product obtained by multiplying.

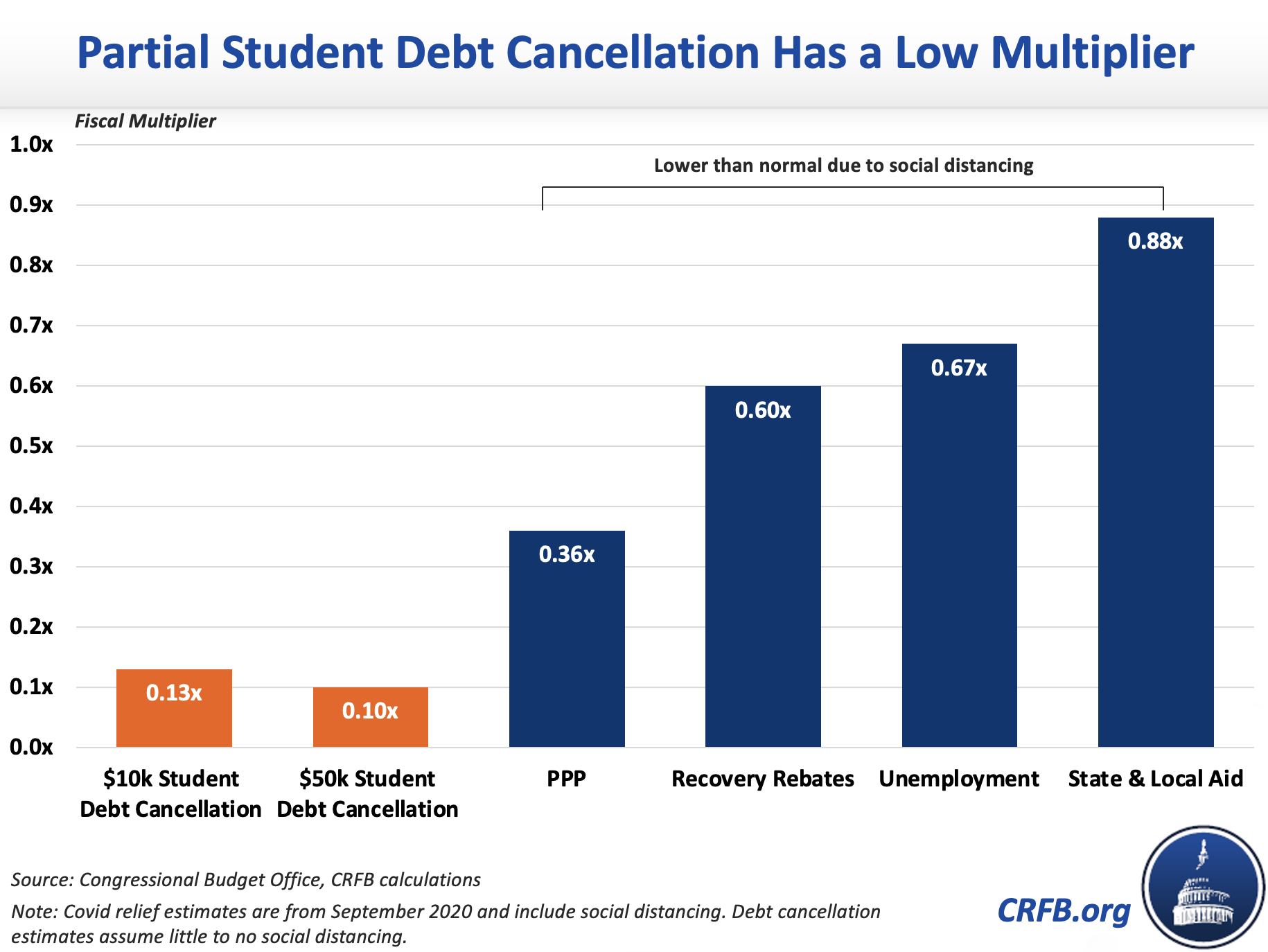

Source: crfb.org

Source: crfb.org

The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR. Although you dont have to worry about any tax consequences of your employer paying your student loan in 2020 due to the CARES Act this benefit could become taxable again when this legislation expires. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees student loans has been extended from the previous deadline of. The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through December 31 2025. The federal loan repayment pause signed into law March 27 2020 via the Coronavirus Aid Relief and Economic Security CARES Act was only supposed to last through Sept.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Such payments would be excluded from the employees income. And then when Trump signed the Covid-19 relief at the end of December 2020 it extended this benefit through 2025. Employers are permitted to provide a student loan repayment benefit to employees contributing up to 5250 annually toward an employees student loans. With the end of the CARES Act on Jan. Department of Education between March 13 2020 and May 1 2022.

Source: hrexecutive.com

Source: hrexecutive.com

That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. And then when Trump signed the Covid-19 relief at the end of December 2020 it extended this benefit through 2025. The federal loan repayment pause signed into law March 27 2020 via the Coronavirus Aid Relief and Economic Security CARES Act was only supposed to last through Sept. The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through December 31 2025. C Maximum loan amountDuring the covered period with respect to any loan guaranteed under section 7a of the Small Business Act 15 USC.

Source: studentaid.gov

Source: studentaid.gov

The new bill also extends the expanded limits for qualified retirement plan loans allowed under the CARES Act for that same 180-day period. The CARES Act provides pandemic relief for employers to help repay employee student loans through an amendment to Section 127 of the IRS Code extended through December 31 2025. In March 2020 Congress passed the CARES Act not only pausing payments but setting interest rates on student loans to 0 and halting collections on defaulted student loans. The Consolidated Appropriations Act extends for five years COVID-19 relief that allows employer-provided student loan repayment as a tax-free benefit to employees under Section 127 of the Internal. Tax Exclusion for Employer Student Loan Repayment Benefits Section 2206 Updated.

Source: patriotsoftware.com

Source: patriotsoftware.com

748 3513 gives temporary relief to federal student loan borrowers in the form of 1 payment and interest accrual suspension and 2 consideration of suspended payments toward loan forgiveness. The amount of the student loan debt repayment made by the employer on behalf of an employee should be included as compensation on the employee. The original coronavirus relief bill known as the CARES Act and signed into law on March 27 2020 helped most federal student loan borrowers by temporarily pausing payments and involuntary. Under the new law no payments are required on federal student loans owned by the US. However these repayments are considered taxable for PIT purposes.

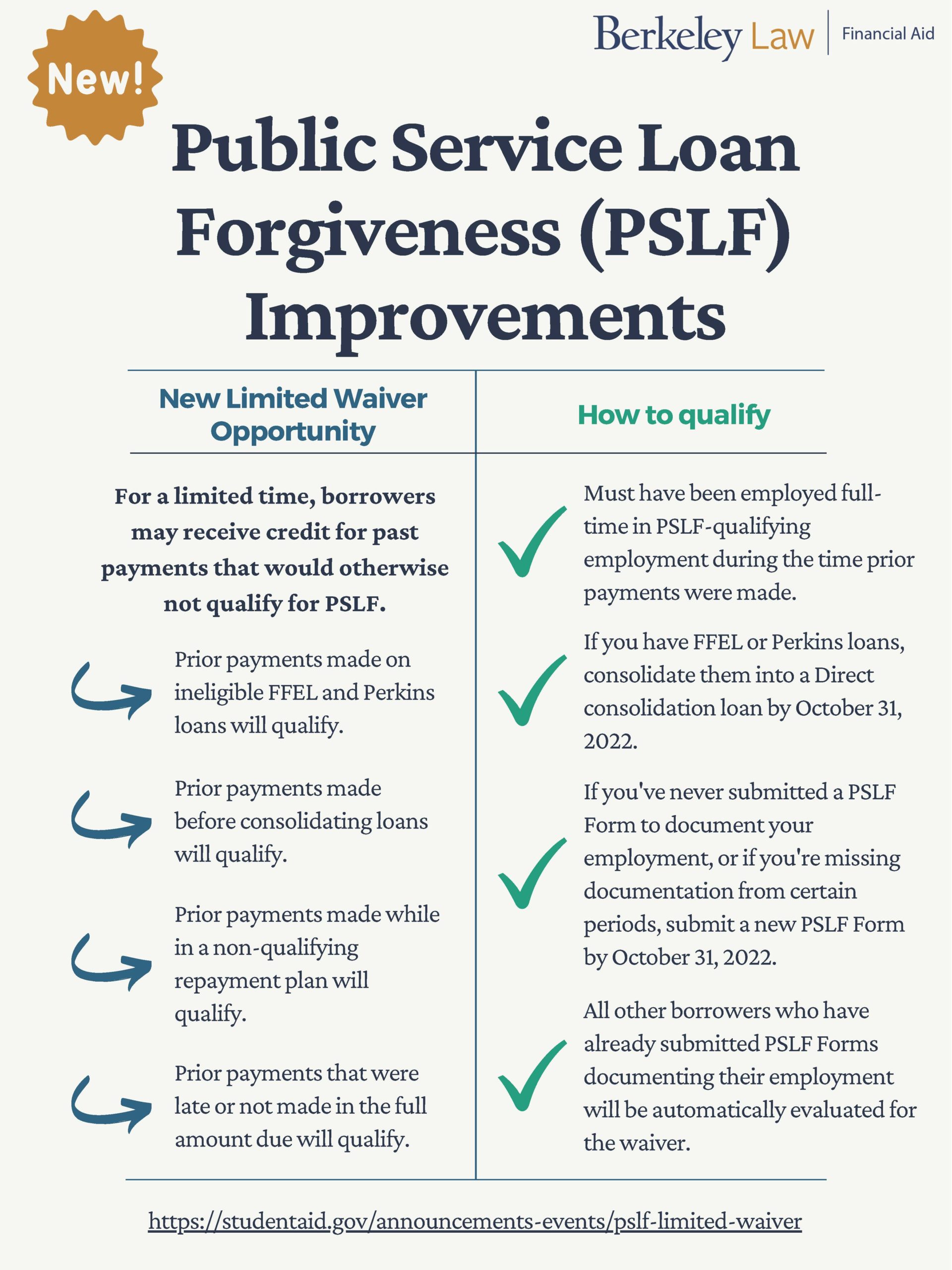

Source: law.berkeley.edu

Source: law.berkeley.edu

Employers who help repay employee student loans take a big step in forming lasting trust and partnership with valued staff. The CARES Act an economic stimulus bill signed by the president on March 27 2020 HR. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. Department of Education or within the extended Federal Family Education Loan FFEL program the loan is not eligible for the CARES Acts. However these repayments are considered taxable for PIT purposes.

Source: studentaid.gov

Source: studentaid.gov

The Consolidated Appropriations Act 2021 CAA passed at the end of 2020 extended the CARES Act student loan provisions to allow employers to make tax-exempt loan-repayment contributions of up. That means an employer could contribute to loan payments and workers wouldnt have to include that. Tax Exclusion for Employer Student Loan Repayment Benefits Section 2206 Updated. Employers who help repay employee student loans take a big step in forming lasting trust and partnership with valued staff. Department of Education between March 13 2020 and May 1 2022.

Source: pinterest.com

Source: pinterest.com

In addition to establishing the Paycheck Protection Program and Employee Retention Credit the CARES Act made employer student loan repayments tax-free until the end of 2020. Department of Education or within the extended Federal Family Education Loan FFEL program the loan is not eligible for the CARES Acts. Under the new law no payments are required on federal student loans owned by the US. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act was passed suspending loan payments stopping collections on defaulted loans and setting a 0 interest rate. The Consolidated Appropriations Act extends for five years COVID-19 relief that allows employer-provided student loan repayment as a tax-free benefit to employees under Section 127 of the Internal.

Source: studentloanplanner.com

Source: studentloanplanner.com

The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers. 31 borrowers will face increasing financial pressure as monthly payments resume. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. The federal loan repayment pause signed into law March 27 2020 via the Coronavirus Aid Relief and Economic Security CARES Act was only supposed to last through Sept. C Maximum loan amountDuring the covered period with respect to any loan guaranteed under section 7a of the Small Business Act 15 USC.

Source: bls.gov

Source: bls.gov

15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021. 748 3513 gives temporary relief to federal student loan borrowers in the form of 1 payment and interest accrual suspension and 2 consideration of suspended payments toward loan forgiveness. The Coronavirus Aid Relief and Economic Security CARES ActTax Relief Congressional Research Service 2 The report also summarizes tax provisions in earlier versions of the CARES Actthe first version of the CARES Act S. 3548 Table A-1 as well as the version released March 22 2020 Table A-26 Table 1. The Coronavirus Aid Relief and Economic Security CARES Act included a provision that allows employers to provide 5250 annually for an employees student loan repayment or tuition reimbursement through 2025.

3548 Table A-1 as well as the version released March 22 2020 Table A-26 Table 1. Employer Student Loan Benefits. And then when Trump signed the Covid-19 relief at the end of December 2020 it extended this benefit through 2025. However the resurgence of the COVID-19 crisis and its effect on the economy prompted multiple White House orders across two administrations to extend the relief. The new bill also extends the expanded limits for qualified retirement plan loans allowed under the CARES Act for that same 180-day period.

Source: insognacpa.com

Source: insognacpa.com

Employers can provide up to 5250 in tax-free student loan repayment benefits. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. The amount of the student loan debt repayment made by the employer on behalf of an employee should be included as compensation on the employee. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act was passed suspending loan payments stopping collections on defaulted loans and setting a 0 interest rate. The Consolidated Appropriations Act extends for five years COVID-19 relief that allows employer-provided student loan repayment as a tax-free benefit to employees under Section 127 of the Internal.

That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018. That means an employer could contribute to loan payments and workers wouldnt have to include that. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act was passed suspending loan payments stopping collections on defaulted loans and setting a 0 interest rate. The federal loan repayment pause signed into law March 27 2020 via the Coronavirus Aid Relief and Economic Security CARES Act was only supposed to last through Sept. The amount of the student loan debt repayment made by the employer on behalf of an employee should be included as compensation on the employee.

Source: studentaid.gov

Source: studentaid.gov

Department of Education or within the extended Federal Family Education Loan FFEL program the loan is not eligible for the CARES Acts. The CARES Act provision allowing employers to contribute up to 5250 tax-free annually to their employees student loans has been extended from the previous deadline of. Under the Coronavirus Aid Relief and Economic Security CARES Act employers can now make nontaxable payments of up to 5250 to employees as student loan repayment assistance but only if the payments are made by December 31 2020 under an educational assistance program that meets the requirements of Internal Revenue Code Code Section 127. Employers can provide up to 5250 in tax-free student loan repayment benefits. That could make a significant dent in a borrowers total debt load which averaged nearly 30000 for the Class of 2018.

Source: plansponsor.com

Source: plansponsor.com

Employer Student Loan Benefits. The federal loan repayment pause signed into law March 27 2020 via the Coronavirus Aid Relief and Economic Security CARES Act was only supposed to last through Sept. The CARES Act and Employer Student Loan Contributions. Text for HR748 - 116th Congress 2019-2020. However these repayments are considered taxable for PIT purposes.

Text for HR748 - 116th Congress 2019-2020. 15-B to include certain employer payments of student loans paid after March 27 2020 and before January 1 2021. However these repayments are considered taxable for PIT purposes. 636a for which an application is approved or pending approval on or after the date of enactment of this Act the maximum loan amount shall be the lesser of 1 the product obtained by multiplying. Such payments would be excluded from the employees income.

Source: educationdata.org

Source: educationdata.org

Under the Coronavirus Aid Relief and Economic Security CARES Act employers can now make nontaxable payments of up to 5250 to employees as student loan repayment assistance but only if the payments are made by December 31 2020 under an educational assistance program that meets the requirements of Internal Revenue Code Code Section 127. It similarly extends the one-year delay in loan repayment for participants with repayment due dates between the first day of the disaster incident period and ending 180 days after the last day of the period. The Coronavirus Aid Relief and Economic Security CARES ActTax Relief Congressional Research Service 2 The report also summarizes tax provisions in earlier versions of the CARES Actthe first version of the CARES Act S. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act was passed suspending loan payments stopping collections on defaulted loans and setting a 0 interest rate. With the end of the CARES Act on Jan.

Source: pinterest.com

Source: pinterest.com

And then when Trump signed the Covid-19 relief at the end of December 2020 it extended this benefit through 2025. A student loan repayment assistance program can help you get a leg up on your finances while also advancing your career. Employers who help repay employee student loans take a big step in forming lasting trust and partnership with valued staff. Federal income taxes on the payments. C Maximum loan amountDuring the covered period with respect to any loan guaranteed under section 7a of the Small Business Act 15 USC.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cares act student loan repayment employer by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.