Your Cares act passed in december images are ready. Cares act passed in december are a topic that is being searched for and liked by netizens today. You can Download the Cares act passed in december files here. Download all free images.

If you’re searching for cares act passed in december pictures information linked to the cares act passed in december keyword, you have pay a visit to the ideal blog. Our website always gives you hints for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Cares Act Passed In December. 2 the term covered period means the period beginning on March 1 2020 and ending on June 30 2020. While that is great news in and of itself heres a look at some of the key. Facing a government shutdown and the expiration of many of the relief programs included in the Coronavirus Aid Relief and Economic Security Act the CARES Act enacted in March 2020 on December 21 2020 Congress passed a 900 billion pandemic relief package as part of a broader 14 trillion government funding bill. 7 The table of contents for this Act is as follows.

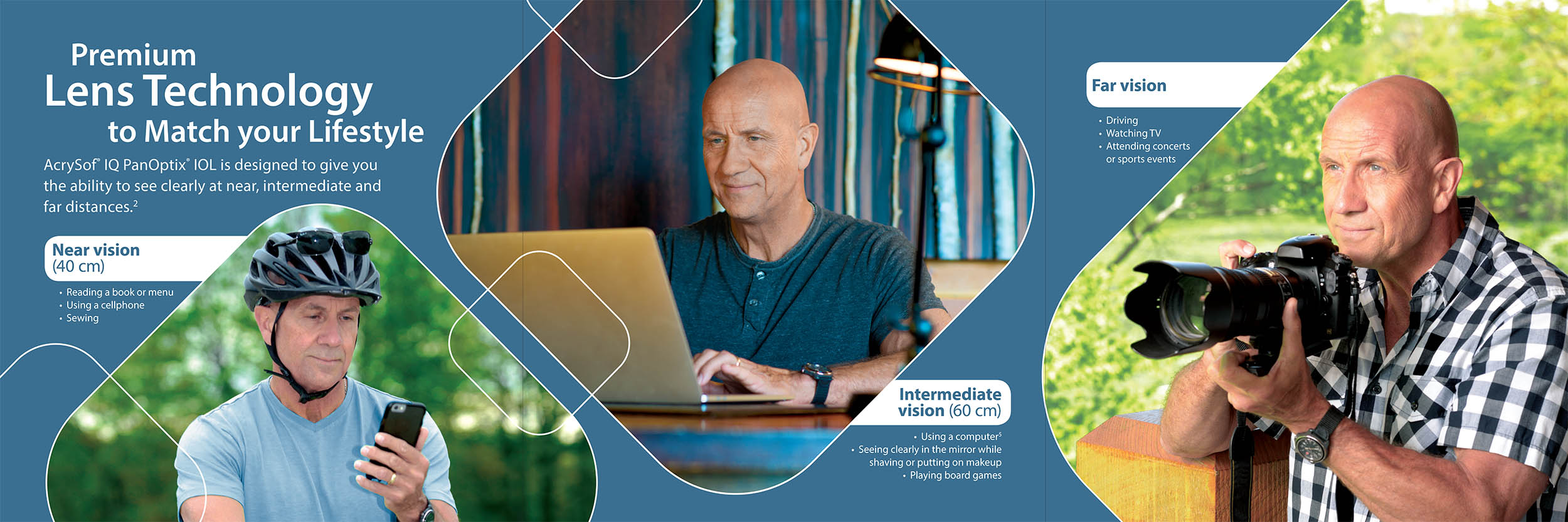

History Of The Affordable Care Act Obamacare Ehealth From ehealthinsurance.com

History Of The Affordable Care Act Obamacare Ehealth From ehealthinsurance.com

It was created to help protect students from predatory practices and abusive loans by making it illegal for student loan providers to demand origination fees late payment penalties or. Read the press release. 4 This Act may be cited as the Coronavirus Aid Re-5 lief and Economic Security Act or the CARES Act. 2301 of the CARES Act to extend the application of the employee retention credit to qualified wages paid after December 31 2020 and before July 1 2021 and to modify the calculation of the credit amount for qualified wages paid during that time2 Following the enactment of the CARES Act the IRS posted Frequently Asked. 7 The table of contents for this Act is as follows. The CARES Act was signed into law on Friday March 27 2020.

Unemployment benefits under the cares act extended into 2021 january 4 2021 by smart hr on december 27 2020 the president signed the next stimulus bill that congress passed on december 21 2020 that includes additional funding for unemployment benefit programs under the coronavirus aid relief and economic security act cares act enacted.

The Consolidated Appropriations Act 2021 a massive tax funding and spending bill that contains a nearly 900 billion coronavirus aid package was passed by Congress on December 21 and signed by President Trump on December 27The emergency coronavirus relief package aims to bolster. Unemployment benefits under the cares act extended into 2021 january 4 2021 by smart hr on december 27 2020 the president signed the next stimulus bill that congress passed on december 21 2020 that includes additional funding for unemployment benefit programs under the coronavirus aid relief and economic security act cares act enacted. The CARES Act was passed by Congress on March 25 2020 and signed into law on March 27 2020. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH. On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic. The 600 checks are half as generous as the 1200 payments distributed under the CARES Act in the spring.

The Consolidated Appropriations Act 2021 was passed by Congress on December 21 2020 and signed into law on December 27 2020. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH. The stimulus package includes 8188 billion for the Education Stabilization Fund dollars available through September 30 2022. Enacted in March 2020 on December 21 2020. On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic.

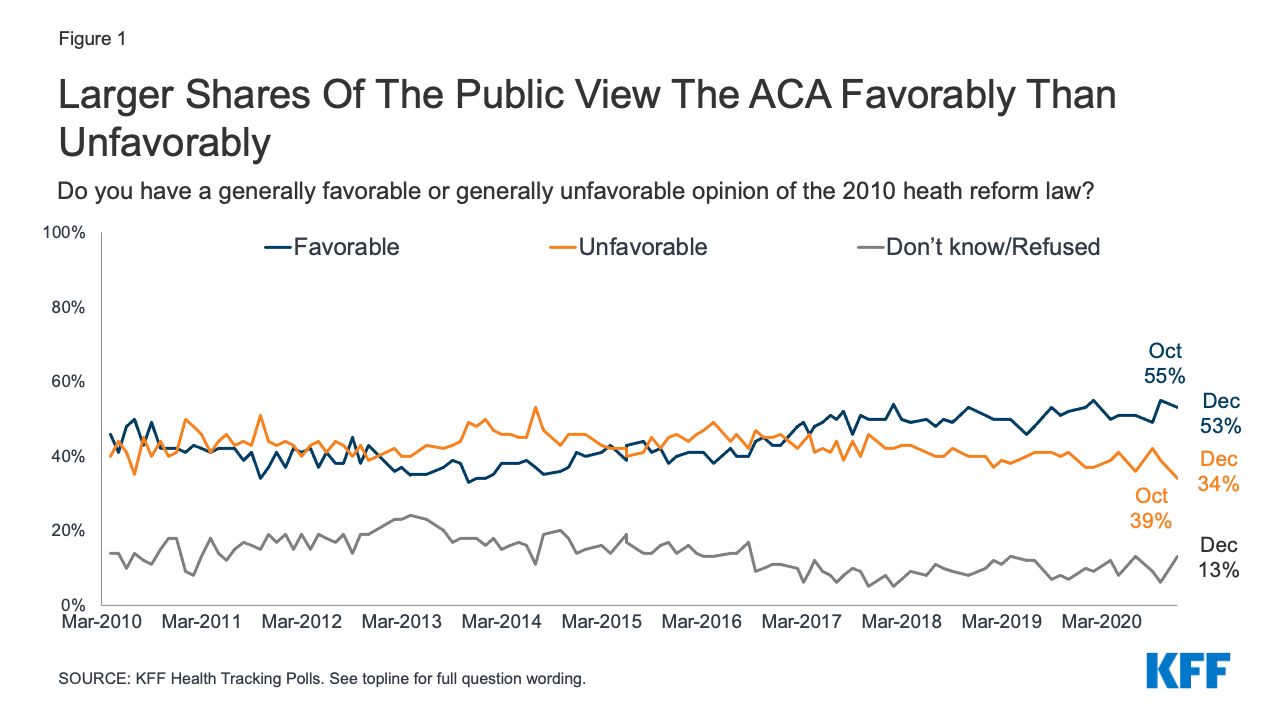

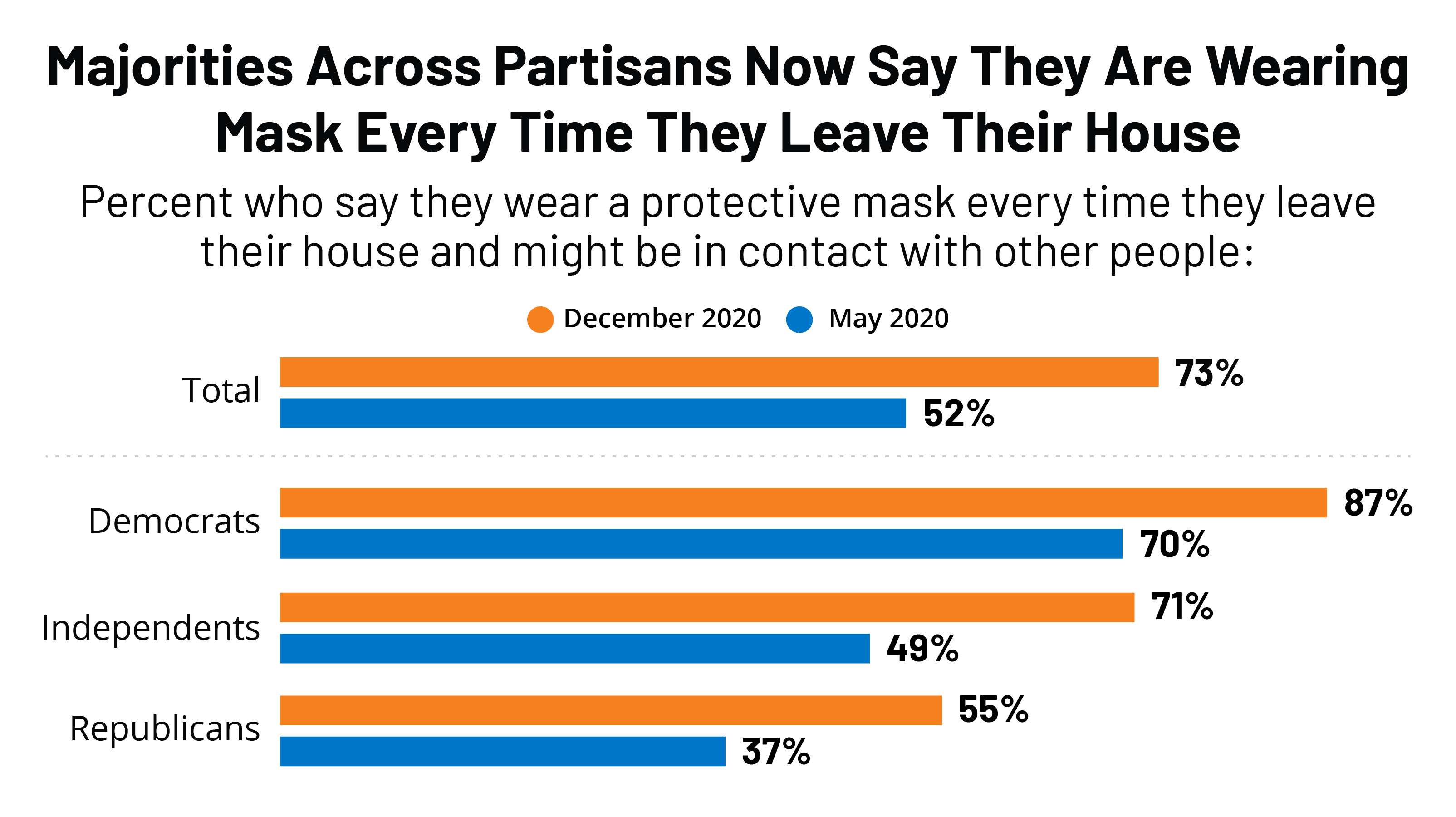

Source: kff.org

Source: kff.org

On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic. Updated Jan 21 2021. 133 includes the Continued Assistance for Unemployed Workers Act of 2020 which provides for an extension of the CARES Act unemployment provisions from December 31 2020. 7 The table of contents for this Act is as follows. The stimulus package includes 8188 billion for the Education Stabilization Fund dollars available through September 30 2022.

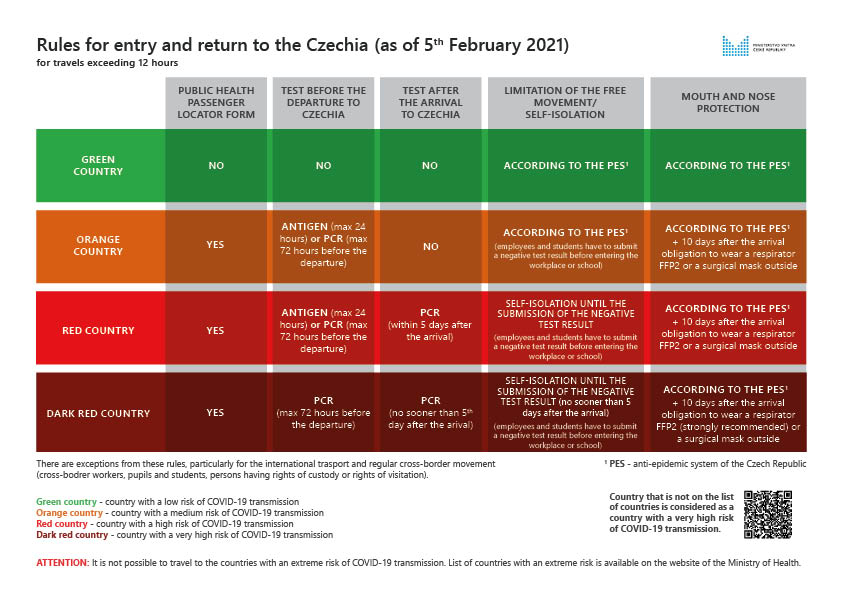

Source: expats.cz

Source: expats.cz

DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH. The bill was presented to the President on March 27 th 2020 and signed into law that day becoming PL. The Coronavirus Aid Relief and Economic Security Act CARES is a bill that responds to the COVID-19 outbreak and its impact on the economy public health state and local governments individuals and businesses. On Friday March 27 the CARES Act passed. December 2020 Federal COVID Relief Bill On December 21 2020 Congress passed the 2100-page Consolidated Appropriations Act of 2021 which includes a stimulus and pandemic relief package of almost 900 billion.

Source: healthaffairs.org

Source: healthaffairs.org

Facing a government shutdown and the expiration of many of the relief programs included in the Coronavirus Aid Relief and Economic Security Act the CARES Act enacted in March 2020 on December 21 2020 Congress passed a 900 billion pandemic relief package as part of a broader 14 trillion government funding bill. 4 This Act may be cited as the Coronavirus Aid Re-5 lief and Economic Security Act or the CARES Act. December 2020 Federal COVID Relief Bill On December 21 2020 Congress passed the 2100-page Consolidated Appropriations Act of 2021 which includes a stimulus and pandemic relief package of almost 900 billion. These distributions are no longer considered RMDs and may be eligible rollover distributions that could be rolled over to a plan that accepts rollover contributions. The CARES Act was enacted March 27 2020 after some individuals may have already taken their 2020 RMDs.

Source: forbes.com

Source: forbes.com

The CARES Act was enacted March 27 2020 after some individuals may have already taken their 2020 RMDs. The CARES Act was passed by Congress on March 25 2020 and signed into law on March 27 2020. Facing a government shutdown and the expiration of many of the relief programs included in the Coronavirus Aid Relief and Economic Security Act the CARES Act enacted in March 2020 on December 21 2020 Congress passed a 900 billion pandemic relief package as part of a broader 14 trillion government funding bill. A Definitions In this section. Enacted in March 2020 on December 21 2020.

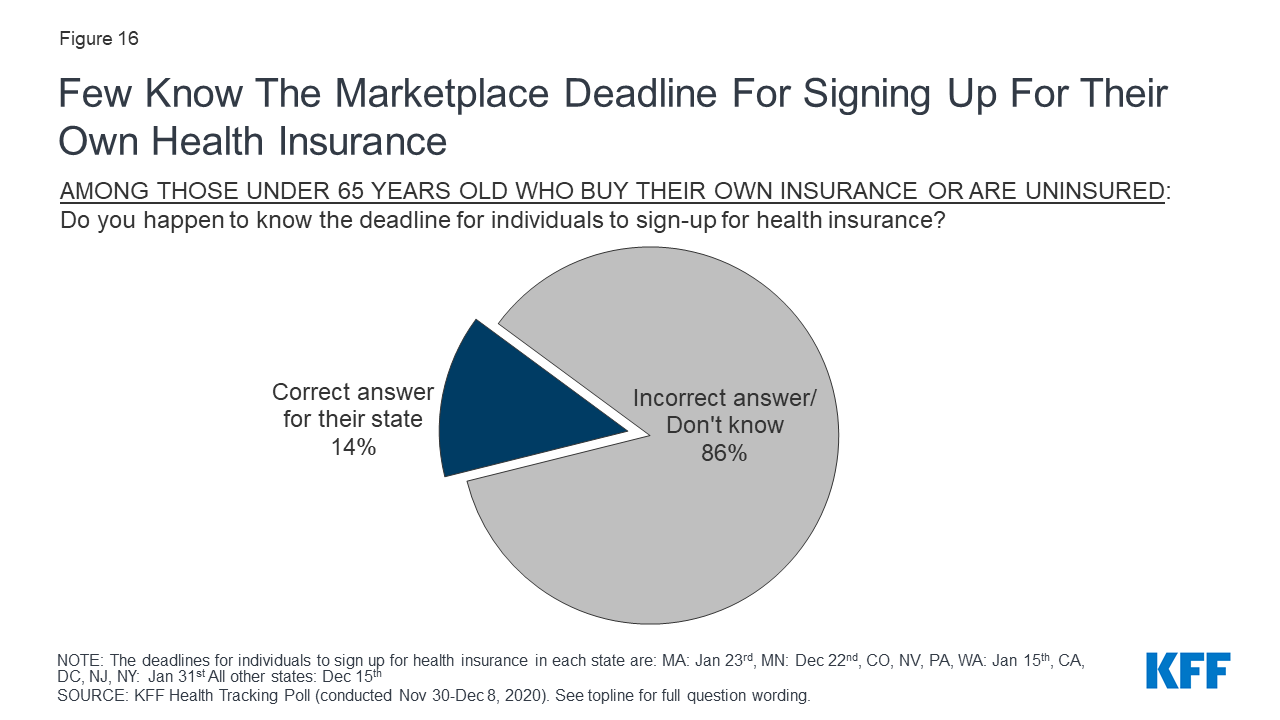

Source: kff.org

Source: kff.org

The bill was presented to the President on March 27 th 2020 and signed into law that day becoming PL. December 2020 Federal COVID Relief Bill On December 21 2020 Congress passed the 2100-page Consolidated Appropriations Act of 2021 which includes a stimulus and pandemic relief package of almost 900 billion. 2301 of the CARES Act to extend the application of the employee retention credit to qualified wages paid after December 31 2020 and before July 1 2021 and to modify the calculation of the credit amount for qualified wages paid during that time2 Following the enactment of the CARES Act the IRS posted Frequently Asked. The CARES Act was signed into law on Friday March 27 2020. Read the press release.

Source: cnbc.com

Source: cnbc.com

These distributions are no longer considered RMDs and may be eligible rollover distributions that could be rolled over to a plan that accepts rollover contributions. On Friday March 27 the CARES Act passed. December 2020 Federal COVID Relief Bill On December 21 2020 Congress passed the 2100-page Consolidated Appropriations Act of 2021 which includes a stimulus and pandemic relief package of almost 900 billion. The Coronavirus Aid Relief and Economic Security Act CARES is a bill that responds to the COVID-19 outbreak and its impact on the economy public health state and local governments individuals and businesses. 4 This Act may be cited as the Coronavirus Aid Re-5 lief and Economic Security Act or the CARES Act.

Source: kff.org

Source: kff.org

Facing a government shutdown and the expiration of many of the relief programs included in the Coronavirus Aid Relief and Economic Security Act the CARES Act enacted in March 2020 on December 21 2020 Congress passed a 900 billion pandemic relief package as part of a broader 14 trillion government funding bill. Americans who made less than 75000 in 2019 are eligible for the full 600 with the. Facing a government shutdown and the expiration of many of the relief programs included in the Coronavirus Aid Relief and Economic Security Act the CARES Act enacted in March 2020 on December 21 2020 Congress passed a 900 billion pandemic relief package as part of a broader 14 trillion government funding bill. The Consolidated Appropriations Act 2021 a massive tax funding and spending bill that contains a nearly 900 billion coronavirus aid package was passed by Congress on December 21 and signed by President Trump on December 27The emergency coronavirus relief package aims to bolster. Enacted in March 2020 on December 21 2020.

Source: npr.org

Source: npr.org

A Definitions In this section. The Consolidated Appropriations Act 2021 a massive tax funding and spending bill that contains a nearly 900 billion coronavirus aid package was passed by Congress on December 21 and signed by President Trump on December 27The emergency coronavirus relief package aims to bolster. The bill was presented to the President on March 27 th 2020 and signed into law that day becoming PL. This bill responds to the COVID-19 ie coronavirus disease 2019 outbreak and its impact on the economy public health state and local governments individuals and businesses. The CARES Act was enacted March 27 2020 after some individuals may have already taken their 2020 RMDs.

Source: cnbc.com

Source: cnbc.com

Section 2203 specified that distributions. It was created to help protect students from predatory practices and abusive loans by making it illegal for student loan providers to demand origination fees late payment penalties or. On March 25th the Senate voted unanimously 96-0 in favor of the Coronavirus Aid Relief and Economic Security CARES Act the third bipartisan bill responding to the COVID-19 pandemic. Section 2203 specified that distributions. 2 the term covered period means the period beginning on March 1 2020 and ending on June 30 2020.

Source: expats.cz

Source: expats.cz

116-136 03272020 Coronavirus Aid Relief and Economic Security Act or the CARES Act. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH. December 2020 Federal COVID Relief Bill On December 21 2020 Congress passed the 2100-page Consolidated Appropriations Act of 2021 which includes a stimulus and pandemic relief package of almost 900 billion. On Friday March 27 the CARES Act passed. The CARES Act was passed by Congress on March 25 2020 and signed into law on March 27 2020.

Source: fsv.cuni.cz

Source: fsv.cuni.cz

Read the press release. 2301 of the CARES Act to extend the application of the employee retention credit to qualified wages paid after December 31 2020 and before July 1 2021 and to modify the calculation of the credit amount for qualified wages paid during that time2 Following the enactment of the CARES Act the IRS posted Frequently Asked. Unemployment benefits under the cares act extended into 2021 january 4 2021 by smart hr on december 27 2020 the president signed the next stimulus bill that congress passed on december 21 2020 that includes additional funding for unemployment benefit programs under the coronavirus aid relief and economic security act cares act enacted. On December 27 2020 the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 CRRSAA which includes 900 billion in supplemental appropriations for COVID-19 relief 14 billion of which will be allocated to support the transit industry during the COVID-19 public health emergency was signed into law. On Friday March 27 the CARES Act passed.

Source: ehealthinsurance.com

Source: ehealthinsurance.com

The Coronavirus Aid Relief and Economic Security Act CARES is a bill that responds to the COVID-19 outbreak and its impact on the economy public health state and local governments individuals and businesses. 636 a that is made during the covered period. Section 2203 specified that distributions. The CARES Act was enacted March 27 2020 after some individuals may have already taken their 2020 RMDs. DIVISION AKEEPING WORKERS PAID AND EMPLOYED HEALTH.

Source: washingtonpost.com

Source: washingtonpost.com

The Coronavirus Aid Relief and Economic Security Act CARES is a bill that responds to the COVID-19 outbreak and its impact on the economy public health state and local governments individuals and businesses. This bill responds to the COVID-19 ie coronavirus disease 2019 outbreak and its impact on the economy public health state and local governments individuals and businesses. 116-136 03272020 Coronavirus Aid Relief and Economic Security Act or the CARES Act. A Definitions In this section. The CARES Act was signed into law on Friday March 27 2020.

Source: expats.cz

Source: expats.cz

Americans who made less than 75000 in 2019 are eligible for the full 600 with the. The 600 checks are half as generous as the 1200 payments distributed under the CARES Act in the spring. The Cares Act was passed in December 2015. 116-136 03272020 Coronavirus Aid Relief and Economic Security Act or the CARES Act. Section 2203 specified that distributions.

The 600 checks are half as generous as the 1200 payments distributed under the CARES Act in the spring. The bill was presented to the President on March 27 th 2020 and signed into law that day becoming PL. The Consolidated Appropriations Act 2021 was passed by Congress on December 21 2020 and signed into law on December 27 2020. The CARES Act was passed by Congress on March 25 2020 and signed into law on March 27 2020. 1 the term covered 7 a loan means a loan guaranteed under section 7 a of the Small Business Act 15 USC.

Source: nytimes.com

Source: nytimes.com

A Definitions In this section. 7 The table of contents for this Act is as follows. 2301 of the CARES Act to extend the application of the employee retention credit to qualified wages paid after December 31 2020 and before July 1 2021 and to modify the calculation of the credit amount for qualified wages paid during that time2 Following the enactment of the CARES Act the IRS posted Frequently Asked. The Coronavirus Aid Relief and Economic Security Act CARES is a bill that responds to the COVID-19 outbreak and its impact on the economy public health state and local governments individuals and businesses. Facing a government shutdown and the expiration of many of the relief programs included in the Coronavirus Aid Relief and Economic Security Act the CARES Act enacted in March 2020 on December 21 2020 Congress passed a 900 billion pandemic relief package as part of a broader 14 trillion government funding bill.

Source: expats.cz

Source: expats.cz

The CARES Act was signed into law on Friday March 27 2020. The Consolidated Appropriations Act 2021 was passed by Congress on December 21 2020 and signed into law on December 27 2020. The 600 checks are half as generous as the 1200 payments distributed under the CARES Act in the spring. The Coronavirus Aid Relief and Economic Security Act CARES is a bill that responds to the COVID-19 outbreak and its impact on the economy public health state and local governments individuals and businesses. A Definitions In this section.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cares act passed in december by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.