Your Care credit pay my provider limit images are available. Care credit pay my provider limit are a topic that is being searched for and liked by netizens today. You can Download the Care credit pay my provider limit files here. Download all royalty-free photos and vectors.

If you’re looking for care credit pay my provider limit pictures information connected with to the care credit pay my provider limit topic, you have come to the ideal blog. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

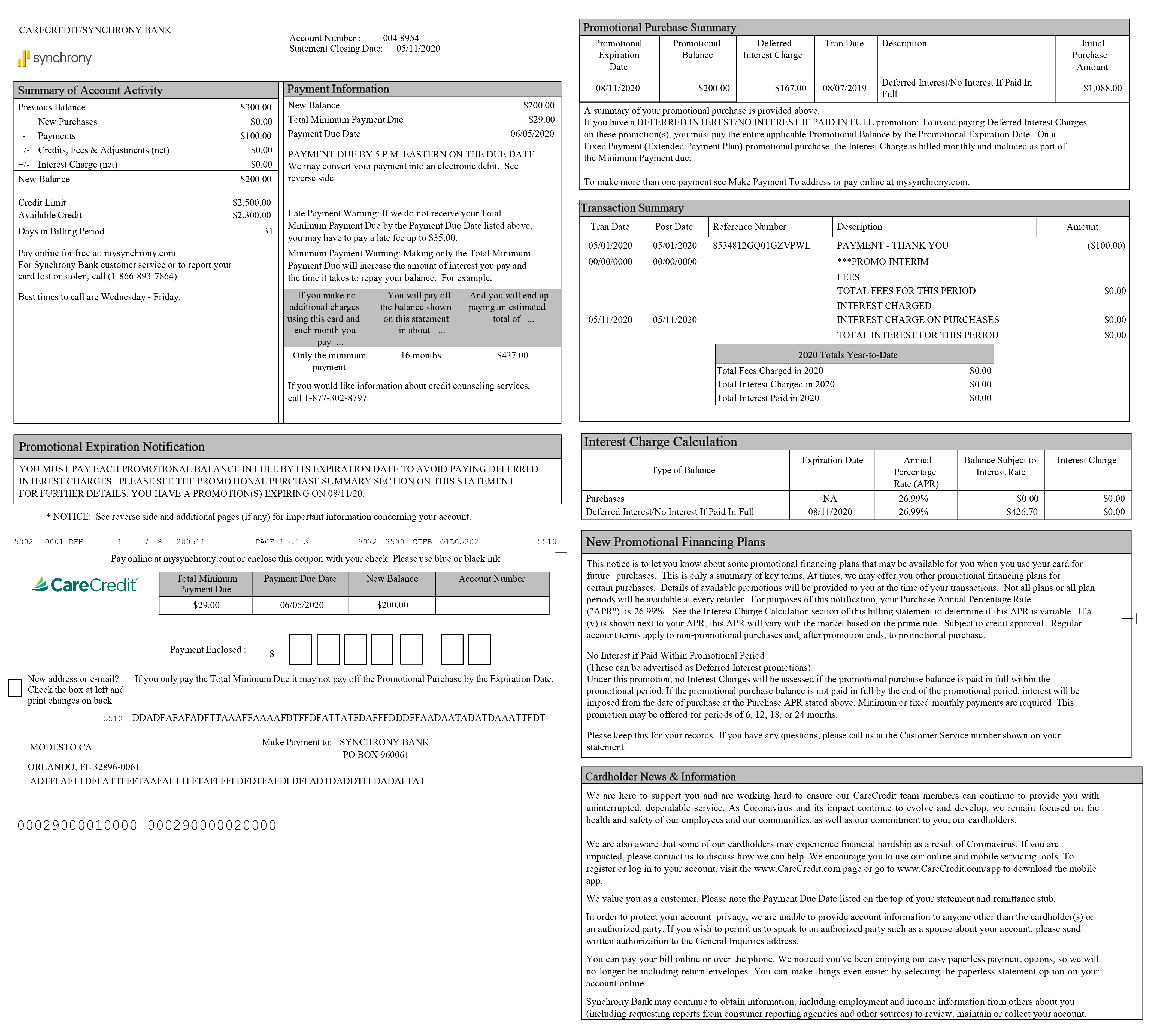

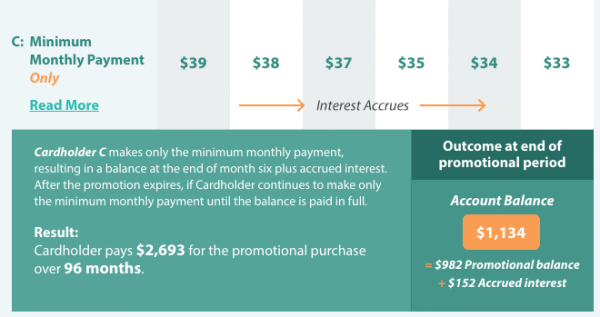

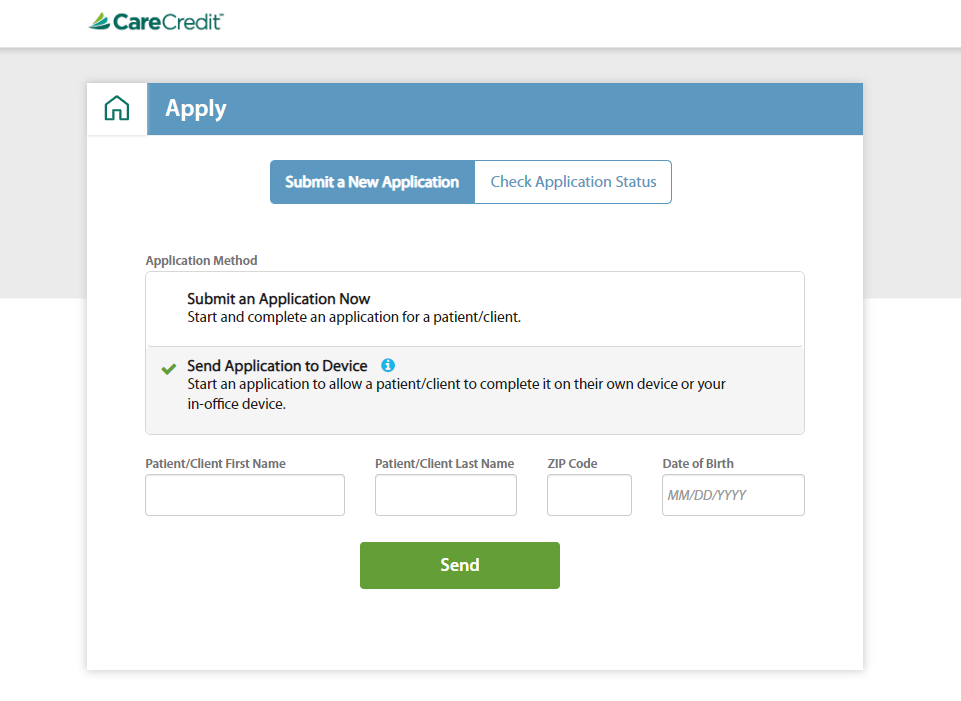

Care Credit Pay My Provider Limit. In case you wish to increase limit beyond the eligible Limit offered by SBI Card please call on SBI Card helpline number at 1860 180 1290 or 39 02 02 02 prefix STD code and check with our customer care executive regarding your eligibility for a credit limit increase basis income documents. However we do believe you should be able to afford a loan with us and we will evaluate your ability to pay the money back. For purchases of 200 or more you can receive a 0 APR period of 6 12 18 or 24 months. Benefits of the tax credit.

Carecredit Reviews 616 Reviews Of Carecredit Com Sitejabber From sitejabber.com

Carecredit Reviews 616 Reviews Of Carecredit Com Sitejabber From sitejabber.com

If a provider opts-in to this process for a care recipient the Commonwealth portion of unspent funds they hold for that recipient will be progressively drawn down by the provider Services Australia will credit the care recipients home care account with their newly accrued unspent Commonwealth subsidy for future use. In this situation you will pay the same as you would pay if you got the care from a network provider. The amount of the credit is a percentage of the child care expenses you paid to a daycare provider for the care of your dependent child under 13 or another dependent. This is a tax credit rather than a tax deductionA tax deduction simply reduces the amount of income that you must pay. Payment by FSAHSA or credit card is not available. If you think you are going to have to pay late call us at 866 893-7867 before the payment due date as we may be.

The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents.

In this case enter Tax-Exempt in the space where Form 2441 asks for the number. The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents. Credit for Child and Dependent Care Expenses 21-5 There is a limit on the amount of work-related expenses that can be used to figure the credit. For older Americans the cost of visiting the dentist can be a shock. From routine appointments to emergency situations or surgeries the CareCredit credit card can give pet owners the peace of mind needed to care for pets big and small with veterinary financing. The limit is 3000 for one qualifying person and 6000 for two or more qualifying persons.

Source: carecredit.com

Source: carecredit.com

The amount of the credit is a percentage of the child care expenses you paid to a daycare provider for the care of your dependent child under 13 or another dependent. If a provider opts-in to this process for a care recipient the Commonwealth portion of unspent funds they hold for that recipient will be progressively drawn down by the provider Services Australia will credit the care recipients home care account with their newly accrued unspent Commonwealth subsidy for future use. Credit for Child and Dependent Care Expenses 21-5 There is a limit on the amount of work-related expenses that can be used to figure the credit. The amount of the credit is a percentage of the child care expenses you paid to a daycare provider for the care of your dependent child under 13 or another dependent. Payment by FSAHSA or credit card is not available.

Source: pinterest.com

Source: pinterest.com

If the care provider is an organization then it is the employer identification number EIN. IF THE ADMINISTRATOR FAILS TO PROVIDE SERVICE OR PAY A CLAIM WITHIN SIXTY 60 DAYS YOU MAY SUBMIT YOUR CLAIM DIRECTLY TO THE INSURER AT THE ABOVE ADDRESS. The American Rescue Plan Act of 2021 significantly increased the Child and Dependent Care Credit for 2021. In Washington Obligations of the service contract provider under this agreement are backed by the full faith and credit of the service contract provider. At Care N Care we believe your dental health can have a direct impact on your overall health and well-being and may have an influence on the development of certain conditions such as diabetes and heart disease.

Source: br.pinterest.com

Source: br.pinterest.com

Base what you owe the provider or facility cost-sharing on what it would pay an in-network provider or facility and show that amount in your explanation of benefits. For purchases of 200 or more you can receive a 0 APR period of 6 12 18 or 24 months. Parents pay a portion of the child care called a copay or copayment directly to the child care provider. Base what you owe the provider or facility cost-sharing on what it would pay an in-network provider or facility and show that amount in your explanation of benefits. In this situation you will pay the same as you would pay if you got the care from a network provider.

Source: pinterest.com

Source: pinterest.com

The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents. This is a tax credit rather than a tax deductionA tax deduction simply reduces the amount of income that you must pay. If you cant provide information regarding the care provider you may still be eligible for the credit if you can show that you exercised due diligence in attempting to provide the required information. CareCredit gives cardholders flexibility - use it at a veterinarian in the network for anything from your pets annual check-up spay or neutering teeth cleaning surgical. At Care N Care we believe your dental health can have a direct impact on your overall health and well-being and may have an influence on the development of certain conditions such as diabetes and heart disease.

Source: es.pinterest.com

Source: es.pinterest.com

In this situation you will pay the same as you would pay if you got the care from a network provider. The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents. Unfortunately its difficult to determine exactly what your credit limit is and you cant be entirely sure of how your credit card provider will calculate your limit. Payments are also not accepted directly at your providers office as well. In addition the the dollar limit the expenses that can be claimed for the dependent care tax credit is limited to the amount of earned income you have.

Source: carecredit.com

Source: carecredit.com

IF THE ADMINISTRATOR FAILS TO PROVIDE SERVICE OR PAY A CLAIM WITHIN SIXTY 60 DAYS YOU MAY SUBMIT YOUR CLAIM DIRECTLY TO THE INSURER AT THE ABOVE ADDRESS. The American Rescue Plan Act of 2021 significantly increased the Child and Dependent Care Credit for 2021. Think of them as more of a credit limit estimator. IF THE ADMINISTRATOR FAILS TO PROVIDE SERVICE OR PAY A CLAIM WITHIN SIXTY 60 DAYS YOU MAY SUBMIT YOUR CLAIM DIRECTLY TO THE INSURER AT THE ABOVE ADDRESS. There are two major benefits of the credit.

Source: carecredit.com

Source: carecredit.com

After years of having dental coverage through employer-sponsored insurance plans people age 65 and older are often surprised to learn upon retirement that Medicare does not pay for most dental work. This is a tax credit rather than a tax deductionA tax deduction simply reduces the amount of income that you must pay. In this case enter Tax-Exempt in the space where Form 2441 asks for the number. In Washington Obligations of the service contract provider under this agreement are backed by the full faith and credit of the service contract provider. For purchases of 200 or more you can receive a 0 APR period of 6 12 18 or 24 months.

Source: pinterest.com

Source: pinterest.com

We use the following information to determine how much the state will pay to the child care provider. If a provider opts-in to this process for a care recipient the Commonwealth portion of unspent funds they hold for that recipient will be progressively drawn down by the provider Services Australia will credit the care recipients home care account with their newly accrued unspent Commonwealth subsidy for future use. Unfortunately its difficult to determine exactly what your credit limit is and you cant be entirely sure of how your credit card provider will calculate your limit. Base what you owe the provider or facility cost-sharing on what it would pay an in-network provider or facility and show that amount in your explanation of benefits. Manual bill pay This option allows you to choose which bills to pay when to pay and how much to pay.

Source: sitejabber.com

Source: sitejabber.com

It is a tax credit for expenses an individual or family incurs for the care of a dependent or other qualified person that can be claimed as a dependent so that the taxpayers are free to work or actively search for a job. At Care N Care we believe your dental health can have a direct impact on your overall health and well-being and may have an influence on the development of certain conditions such as diabetes and heart disease. From routine appointments to emergency situations or surgeries the CareCredit credit card can give pet owners the peace of mind needed to care for pets big and small with veterinary financing. If a provider opts-in to this process for a care recipient the Commonwealth portion of unspent funds they hold for that recipient will be progressively drawn down by the provider Services Australia will credit the care recipients home care account with their newly accrued unspent Commonwealth subsidy for future use. After years of having dental coverage through employer-sponsored insurance plans people age 65 and older are often surprised to learn upon retirement that Medicare does not pay for most dental work.

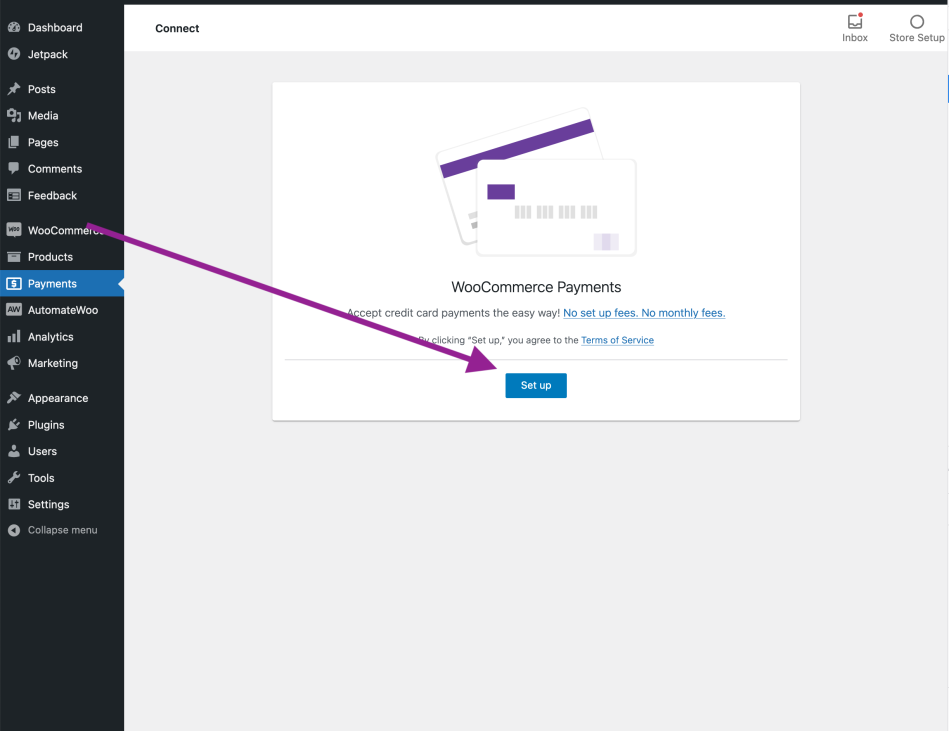

Source: woocommerce.com

Source: woocommerce.com

We are not like the local banks that are only lend to a select few. Consolidate your expenses onto your Mastercard credit card account. If you cant provide information regarding the care provider you may still be eligible for the credit if you can show that you exercised due diligence in attempting to provide the required information. It is a tax credit for expenses an individual or family incurs for the care of a dependent or other qualified person that can be claimed as a dependent so that the taxpayers are free to work or actively search for a job. The Child and Dependent Care Credit is also referred to as the Elderly Dependent Care Credit or the Aging Parent Tax Credit.

Source: carecredit.com

Source: carecredit.com

If you think you are going to have to pay late call us at 866 893-7867 before the payment due date as we may be. In Washington Obligations of the service contract provider under this agreement are backed by the full faith and credit of the service contract provider. In this situation you will pay the same as you would pay if you got the care from a network provider. If a provider opts-in to this process for a care recipient the Commonwealth portion of unspent funds they hold for that recipient will be progressively drawn down by the provider Services Australia will credit the care recipients home care account with their newly accrued unspent Commonwealth subsidy for future use. In case you wish to increase limit beyond the eligible Limit offered by SBI Card please call on SBI Card helpline number at 1860 180 1290 or 39 02 02 02 prefix STD code and check with our customer care executive regarding your eligibility for a credit limit increase basis income documents.

Source: nerdwallet.com

Source: nerdwallet.com

If you think you are going to have to pay late call us at 866 893-7867 before the payment due date as we may be. What are examples of work-related expenses. For older Americans the cost of visiting the dentist can be a shock. In Washington Obligations of the service contract provider under this agreement are backed by the full faith and credit of the service contract provider. Rushmore Credit is an option for all credit types.

Source: sitejabber.com

Source: sitejabber.com

After years of having dental coverage through employer-sponsored insurance plans people age 65 and older are often surprised to learn upon retirement that Medicare does not pay for most dental work. Parents pay a portion of the child care called a copay or copayment directly to the child care provider. Pay My Bill Beth Kaiser 2021-10-19T1650420000 Pay My Bill While you certainly have the option to pay your bill via standard mail delivery or over the phone many people prefer the convenience of the St. This is a tax credit rather than a tax deductionA tax deduction simply reduces the amount of income that you must pay. Think of them as more of a credit limit estimator.

Source: pinterest.com

Source: pinterest.com

Unfortunately its difficult to determine exactly what your credit limit is and you cant be entirely sure of how your credit card provider will calculate your limit. The Child Care Tax Credit helps working parents pay for daycare expenses for children under 13 incapacitated spouses and qualifying adult dependents. So if you only make 2000 for the year you can only use 2000 in. Benefits of the tax credit. There are two major benefits of the credit.

Source: wallethub.com

Source: wallethub.com

Pay My Bill Beth Kaiser 2021-10-19T1650420000 Pay My Bill While you certainly have the option to pay your bill via standard mail delivery or over the phone many people prefer the convenience of the St. Benefits of the tax credit. Rushmore Credit is an option for all credit types. CareCredit gives cardholders flexibility - use it at a veterinarian in the network for anything from your pets annual check-up spay or neutering teeth cleaning surgical. Unfortunately its difficult to determine exactly what your credit limit is and you cant be entirely sure of how your credit card provider will calculate your limit.

Source: carecredit.com

Source: carecredit.com

The limit is 3000 for one qualifying person and 6000 for two or more qualifying persons. In this case enter Tax-Exempt in the space where Form 2441 asks for the number. The American Rescue Plan Act of 2021 significantly increased the Child and Dependent Care Credit for 2021. For purchases of 200 or more you can receive a 0 APR period of 6 12 18 or 24 months. Unfortunately its difficult to determine exactly what your credit limit is and you cant be entirely sure of how your credit card provider will calculate your limit.

Source: carecredit.com

Source: carecredit.com

The Child and Dependent Care Credit is also referred to as the Elderly Dependent Care Credit or the Aging Parent Tax Credit. Credit for Child and Dependent Care Expenses 21-5 There is a limit on the amount of work-related expenses that can be used to figure the credit. The American Rescue Plan Act of 2021 significantly increased the Child and Dependent Care Credit for 2021. For purchases of 200 or more you can receive a 0 APR period of 6 12 18 or 24 months. At Care N Care we believe your dental health can have a direct impact on your overall health and well-being and may have an influence on the development of certain conditions such as diabetes and heart disease.

Source: pinterest.com

Source: pinterest.com

We are not like the local banks that are only lend to a select few. Taking care of your health includes caring for your teeth too. The limit is 3000 for one qualifying person and 6000 for two or more qualifying persons. After years of having dental coverage through employer-sponsored insurance plans people age 65 and older are often surprised to learn upon retirement that Medicare does not pay for most dental work. Online credit card limit calculators can give you a vague idea of what your credit limit might look like.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title care credit pay my provider limit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.